RWA simulation – A transparent overview of the development of capital requirements

RWA (risk-weighted assets) is a key figure that can be used to measure and manage the capital held by a bank in relation to the risks associated with its assets. The RWA simulation was redesigned when CRR III came into force on January 1, 2025. At the same time, capital requirements must continue to be appropriately reflected in planning and the necessary stress scenarios in accordance with ICAAP and MaRisk, and forecasts for the future must be determined. A quick overview of how you can keep track of the development of your capital requirements in a transparent manner.

RWA simulation – efficient, consistent and compliant

RWA calculation was put on a new footing when CRR III came into force on January 1, 2025. At the same time, it is of course still necessary to adequately reflect the capital requirements in the planning and the necessary stress scenarios in accordance with ICAAP and MaRisk and to determine future forecasts.

Based on our newly developed RWA Content App module for reporting in accordance with CRR IIII, we have also developed an RWA simulation using the same calculation method so that you can analyze various future developments and the effects on your institution’s capital adequacy in detail using granular individual transaction data.

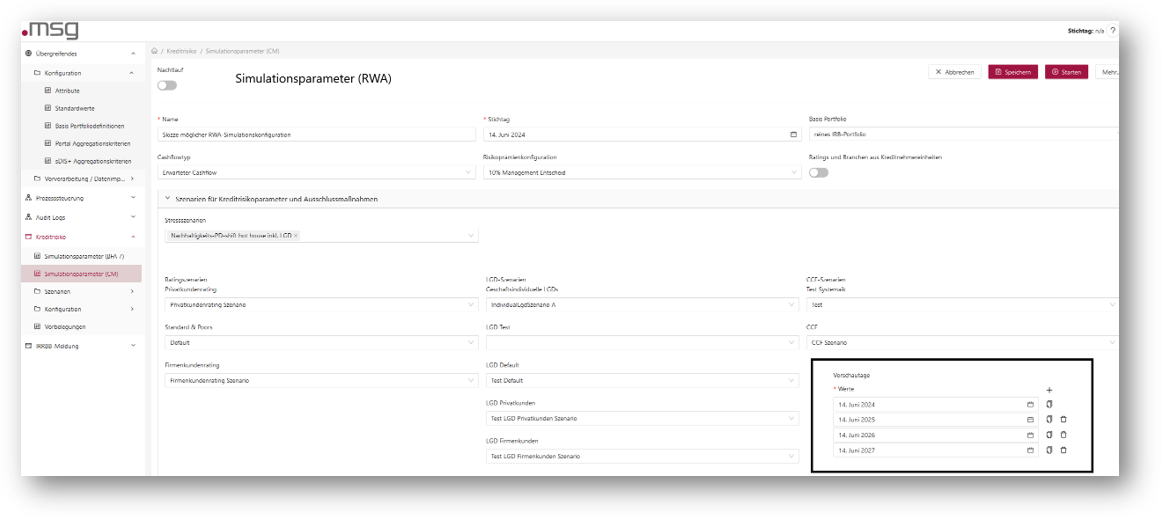

Figure 1: Launchpad of the Risk and Reporting Platform (ORRP) and the associated simulation configurations for the RWA simulation

Potential scenario-dependent countermeasures and their effectiveness can also be analyzed in advance. Both ad hoc scenarios can be analyzed and fixed rule evaluations can be evaluated in standard reporting.

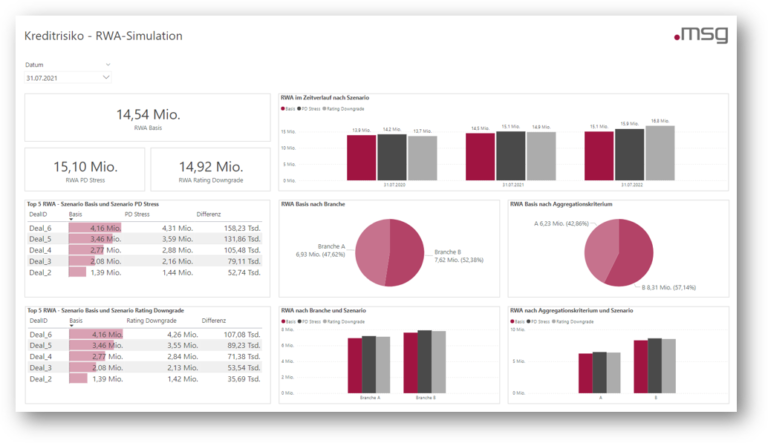

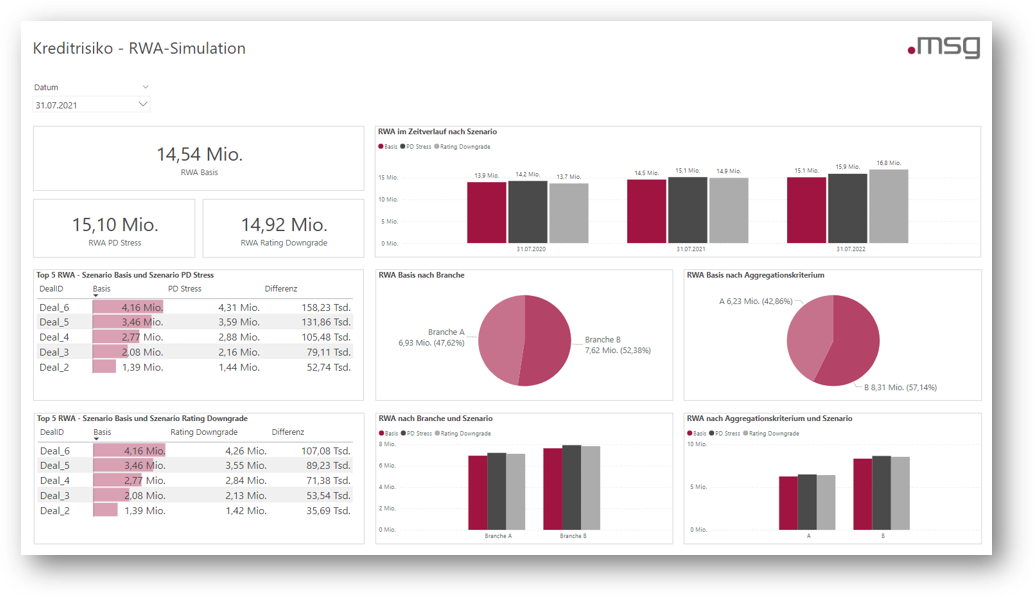

Figure 2: Reporting of standard scenarios

With our RWA Content App and our in-depth experience in the context of reporting and risk management, we are the ideal partner to work with you to design an excellent solution for forecasting your institution’s capital requirements.

More information?

We would be happy to present our solution to you personally - just contact us.

You must login to post a comment.