Impairment tests of the lending business (PAAR) – a classification

Impairment tests (PAAR) were a key focus of BaFin's audits in 2025 and will continue to shape audit practice in 2026. In this article, we provide a concise overview of the regulatory context, the procedure model for a PAAR audit, and our experiences and observations from supporting institutions before and during the audit.

Supervisory context

Impairment tests of the lending business have their origins in the establishment of the Single Supervisory Mechanism (SSM) in 2014:

The assumption of direct banking supervision over the significant institutions (SIs) in the eurozone was preceded by an asset quality review, i.e. an intensive review of assets. The result was sobering1:

- EUR 47.5 billion need for valuation adjustments in the book value

- Increase in the volume of non-performing loans by EUR 136 billion to EUR 879 billion

- Additional capital requirement for 25 institutions amounting to EUR 24.6 billion

In response to this, the European Central Bank (ECB) published its guidance to banks on non-performing loans in 2017. As this only applies to ECB-supervised institutions on the one hand and comparatively higher levels of non-performing loans were assumed in the balance sheets of less significant institutions (LSIs) on the other, the European Banking Authority (EBA) issued its own guidelines on management of non-performing and forborne exposures in October 2018. Taking into account the proportionality aspects, the core elements were adopted in Germany in the sixth MaRisk amendment in 2021.

These aforementioned aspects “have now also led to operational consequences for less significant institutions […] as a result of the PAAR audits since the third quarter of 2015”2:

Since then, impairment tests PAAR (in german: Prüfung Aufsichtlich Angemessener Risikovorsorge/Audit of supervisory risk provisioning) have also been a regular subject of regulatory audits for LSIs.

Impairment tests PAAR § 44 KWG - impulse day

Get even more insights at our impulse day on 5 February 2026 in Frankfurt a.M. on how impairment tests are implemented as a supervisory focus in accordance with Section 44 KWG - with a focus on methodology, risk provisioning in Pillars 1 & 2, audit procedures and current practical examples.

The area of impairment testing has become particularly topical in the Federal Financial Supervisory Authority’s (BaFin) “Risks in Focus 2025“: BaFin intends to counter the risks arising from the default of corporate loans and the associated increase in default risks for banks as follows:

BaFin conducts targeted special audits on the lending business and impairment tests, focussing on the general economic environment, among other things. It will intensify these audits.3

At this point, it should be mentioned that PAAR audits are generally carried out alongside the established credit process audits. A “traditional” credit process audit generally results in findings with reference to MaRisk paragraphs and, based on this, an overall assessment with regard to proper business organisation in accordance with Section 25a KWG. The result of a PAAR audit, on the other hand, is a need for (additional) valuation adjustments based on the audited credit exposures. The subject matter of the audit is determined by the audit order issued by BaFin: As a rule, credit process audits and impairment tests are ordered in combination, although the scope and nature of the credit process audit can vary. The ordering of a pure PAAR audit without an explicit link to a credit process audit was also observed in 2025.

Procedure model Impairment test

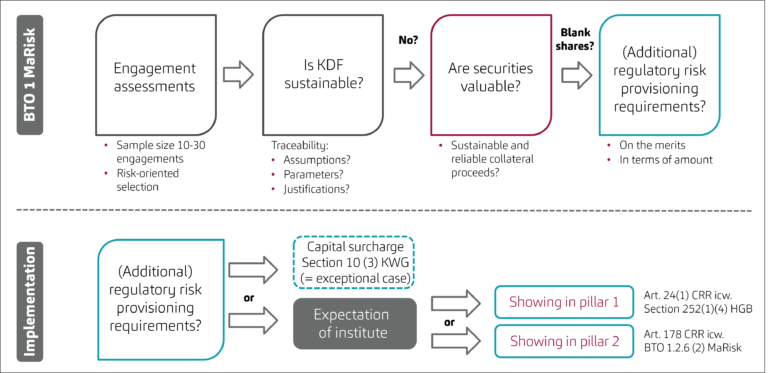

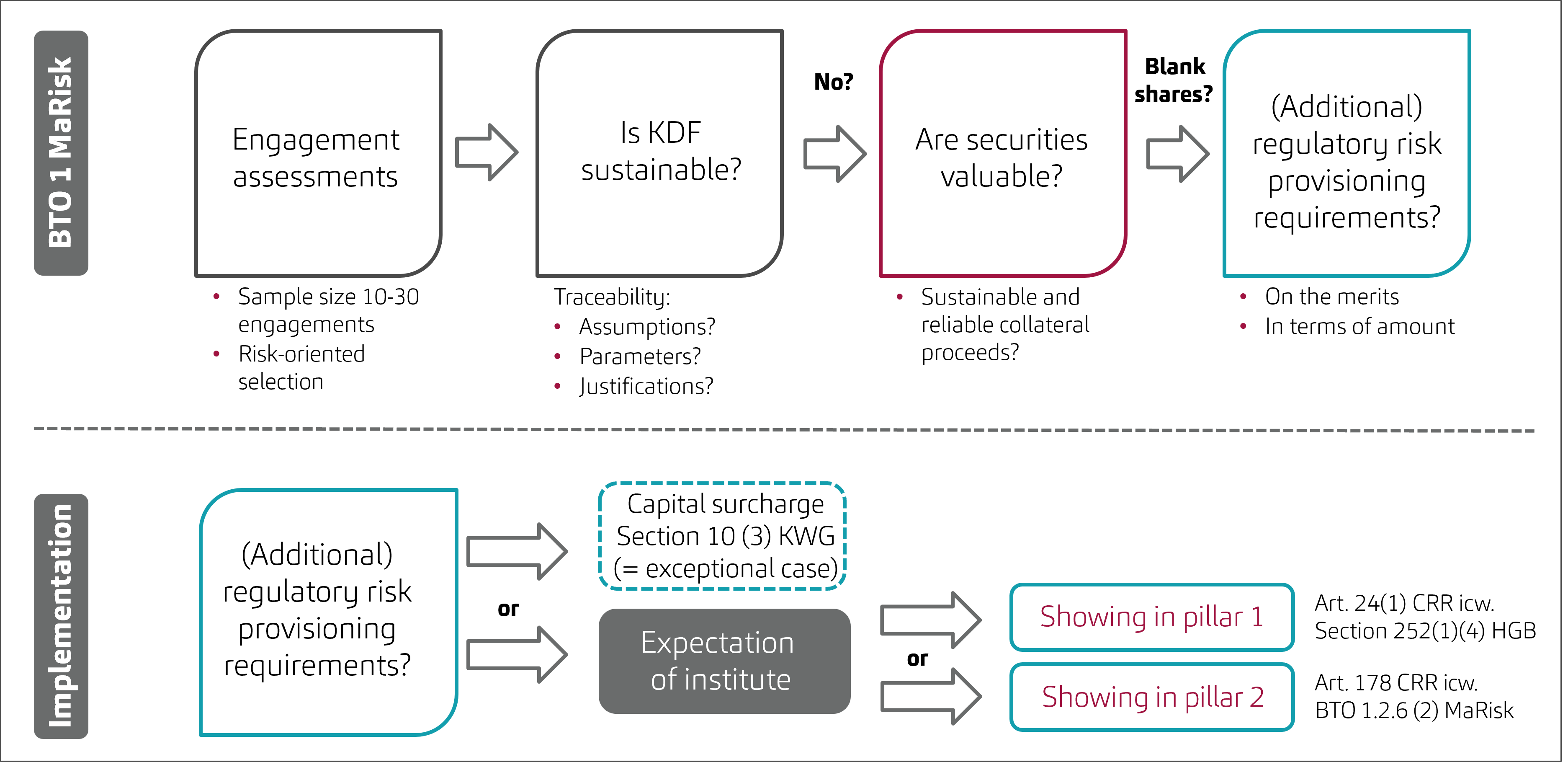

The following diagram provides a brief overview of the procedure model and the result:

Figure 1: PAAR assessment: Procedure model in Section 44 – assessment (click to enlarge)

Based on a sample size specified by BaFin, the first step of the audit involves an assessment of the borrower’s sustainable debt servicing capacity or the property/project financing as the primary source of repayment. This audit step should not be underestimated under any circumstances and goes into great depth in terms of assumptions, parameters and justifications: standardised, objective and sustainable assessment standards, the consideration of replacement investments as well as opposing tax effects when eliminating extraordinary effects are just a few of the aspects mentioned here.

If the auditors come to a negative assessment of the debt servicing capacity, the next step in the audit is a separate impairment assessment of the collateral as a secondary source of repayment.

This may result in a different – supervisory – risk provisioning requirement:

- On the merits: The institution has not yet included the exposure in the default portfolio and has not yet recognised any risk provisions.

- In terms of amount: The institution itself has already recognised a risk provision: However, the auditors arrive at a different collateral valuation and thus vice versa at a higher shielding requirement than that on which the institution itself is based. It should also be mentioned here that a deviation in individual cases is also methodological, because the supervisory expectations sometimes go beyond the possibilities for risk provisioning under commercial law.

An additional regulatory risk provisioning requirement is thus quantified in terms of exposure and individually allocated to Pillar 1 (= risk provisioning under commercial law) and/or Pillar 2 (shielding in the RBC from both an economic and normative perspective) and reported as an audit result.

Practical experience

msg for banking was also able to support some institutions before and during impairment tests in 2025. We are happy to provide a brief insight:

- The number of impairment tests does indeed appear to have increased significantly. BaFin’s 2026 annual report will provide transparency in this regard.

- The Deutsche Bundesbank is regularly, but not exclusively, entrusted with carrying out the audit.

- The audits carried out by auditing firms regularly differ in terms of the procedure model.

- In the case of “credit processes” plus “PAAR” audit requests, the scope of the audit for the credit processes varies considerably: we have observed everything from a comprehensive BTO 1 credit business audit to a “credit processes light” audit. As a rule, the BaFin audit order sets the framework for this.

- A great deal can be achieved with good audit preparation and sound reasoning, both in terms of credit processes and engagement.

- We have not yet experienced an audited institution without additional supervisory risk provisioning requirements.

Individual preparation and support

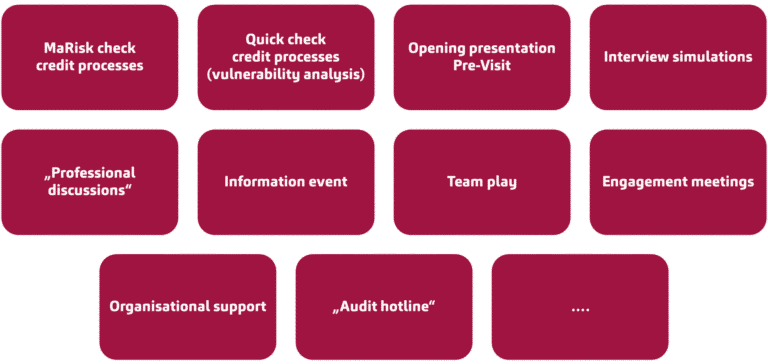

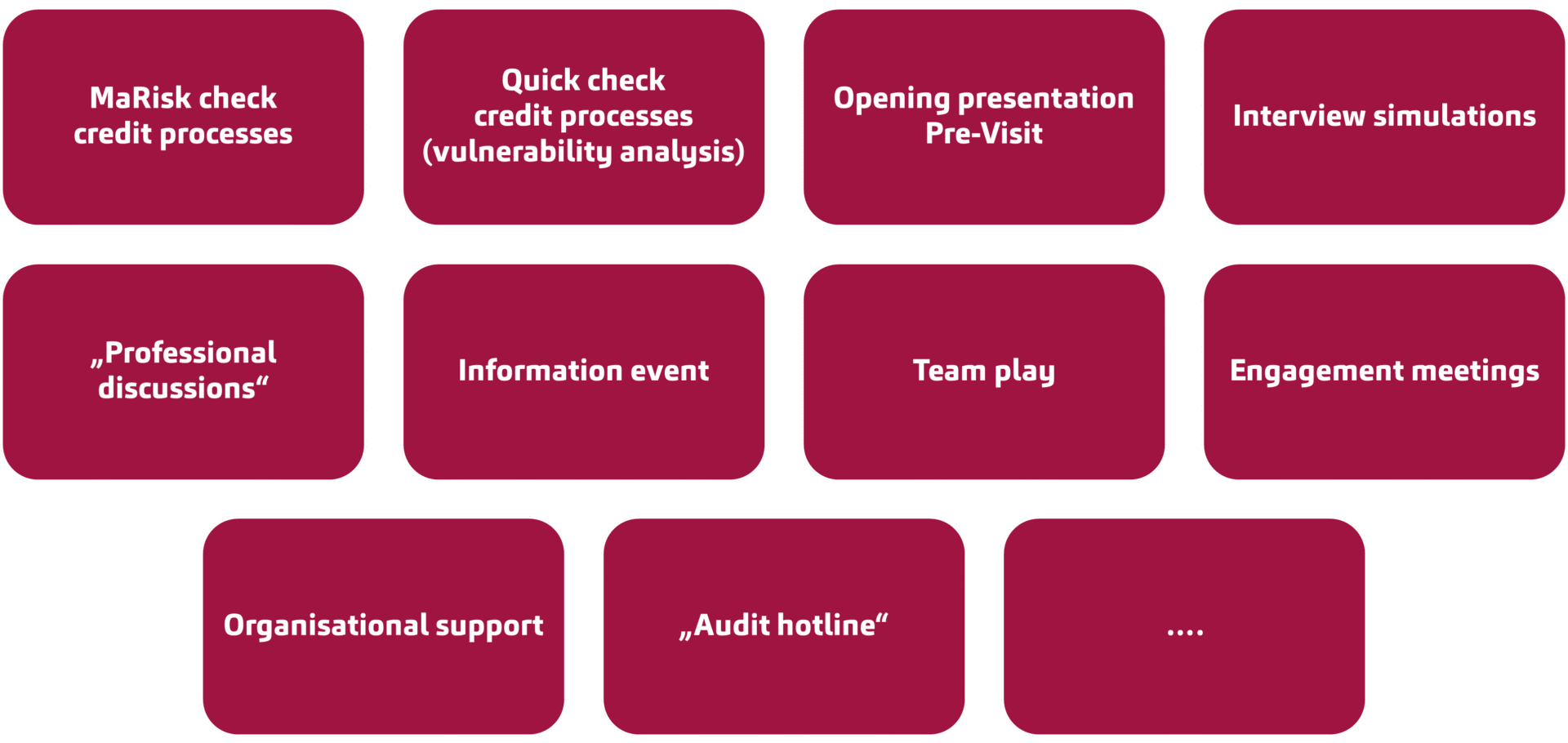

As long-standing, experienced consultants with a banking background, we combine credit practice with supervisory expertise. We would therefore be delighted to support you. In this context, our spectrum ranges from MaRisk checks BTO 1 credit processes that are independent of specific events to customised support before and during a 44 audit according to your individual starting position and objectives.

Figure 2: Individual preparation and support (click to enlarge)

Impulse day impairment test PAAR on 5 February 2026

While we have only been able to give you a brief insight here, we will be devoting an impulse day to the topic in detail due to its importance. In addition to in-depth information beyond the scope of this article, we will also provide a practical perspective in two respects:

- Dominik Leichinger, Head of Auditing in the Banking Audits Department of the Bundesbank HV NRW, will shed light on the topic from the perspective of auditing practice and is looking forward to a constructive dialogue and exchange – questions are expressly welcome and encouraged!

- Fabian Blasberg, Head of the Corporate Clients Department at Stadtsparkasse Solingen, will report from the perspective of an audited institution in 2025.

We would be delighted to invite you to attend – as well as to discuss this or other credit-related topics individually. Please do not hesitate to contact me.

You must login to post a comment.