FIDA & Open Finance – From overview to application: Focus on two use cases

In the Financial Data Access (FIDA) regulation, the EU has established the framework for access to financial data. This marks another step toward open finance, as the regulation enables access to a wide range of financial and customer data held by banks, insurers, and asset managers. This article provides a concise overview of FIDA & Open Finance, from strategic classification and organizational preparation to practical use cases, structured along key areas of action.

FIDA & Open Finance – from overview to application

Focus on two use cases

The Financial Data Access (FIDA) regulation is bringing movement to the European financial market. It transfers the basic idea of open banking to a broader range of financial data – from insurance and pension data to investment and credit data from retail customers and small and medium-sized enterprises (SMEs).

For banks, insurers and other financial service providers, this means: Now is the right time to act!

With the opportunities and possibilities of FIDA, market participants will also face a number of challenges. Banks should therefore take a structured approach to this complex regulation and, for example, define governance for a FIDA program, evaluate the strategic position, analyze the technical and professional impact and develop concrete action steps based on this.

But it’s not just the challenges that are great – the potential that the EU regulation brings with it is also enormous! The major expansion of the data spectrum opens up opportunities for a wide range of innovative processes and services.

Use cases – structured thinking, targeted implementation

The opportunities and bank-specific potential of FIDA can only be determined by identifying possible use cases. For a realistic assessment of these use cases, various functional and technical aspects must be taken into account. It helps to categorize and evaluate the identified use cases based on previously defined criteria.

For example, the application of the dimensions listed below helps to systematically identify bank-specific potential and to sharpen the strategic position:

- Service category – process optimization vs. application service:

- example Process optimization: know-your-customer(KYC) optimization

- example Application service: credit risk management

- End benefit – customer benefit/bank benefit:

- Improving the transparency about financial situation

- Business generation for banks

- Data basis – few vs. many FIDA data:

- What FIDA data is used?

- How can it be supplemented with internal data?

- Technical complexity – low vs. high:

- Are other technologies used in addition to connecting the FIDA APIs, such as artificial intelligence?

- Market positioning: Common vs. USP

- Degree of personalization

Based on these categories, assessments can be made regarding the required skill setup, the make-or-buy decision and the cost/benefit ratio.

This provides a solid basis for the development of use cases – regardless of whether the focus is on increasing efficiency, new revenue models or a better customer experience.

Real-world use cases are the best way to demonstrate the added value of FIDA. Below we present and briefly explain two of our use cases.

Use case 1: The loan application process reimagined

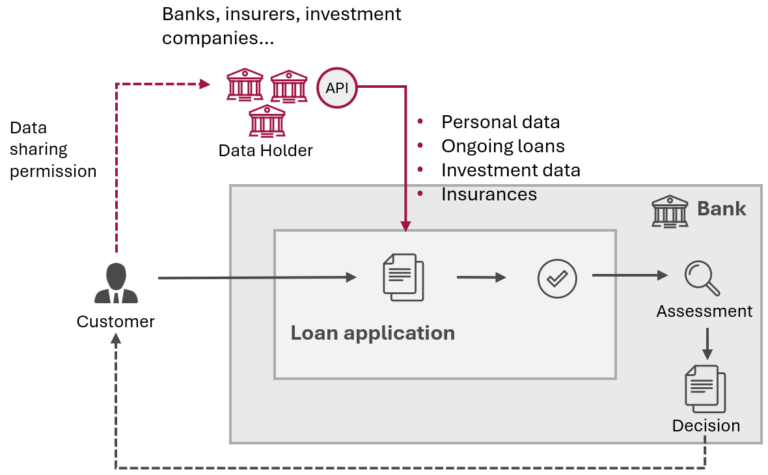

Use case 1 shows how FIDA can transform the traditional loan application process – for both banks and customers.

The challenge

Loan calculators and application forms are often abandoned. This is because customers obtain their financial data from different financial service providers and have to enter it manually. This makes it difficult for banks to promote this product to individual customers.

The solution

With the customer’s consent, FIDA enables access to their financial data, such as current loans, investments, and insurance policies. This goes far beyond the account information and transaction data currently available under PSD2.

The data released for processing by FIDA can be retrieved directly from the various sources via a standardized API and integrated into the loan application process securely and error-free with minimal user effort.

Based on this data, the bank can prepare an individual loan offer for the customer and possibly transfer the data directly into the application process.

Figure 1: Use case: Credit application process

The added value

The bank gains a more complete picture of the customer’s financial situation and can therefore refine its risk assessment and optimize its credit offering.

The improved usability of the credit application process not only increases customer loyalty but also leads to a higher conversion rate.

Use case 2: Personalized premium services

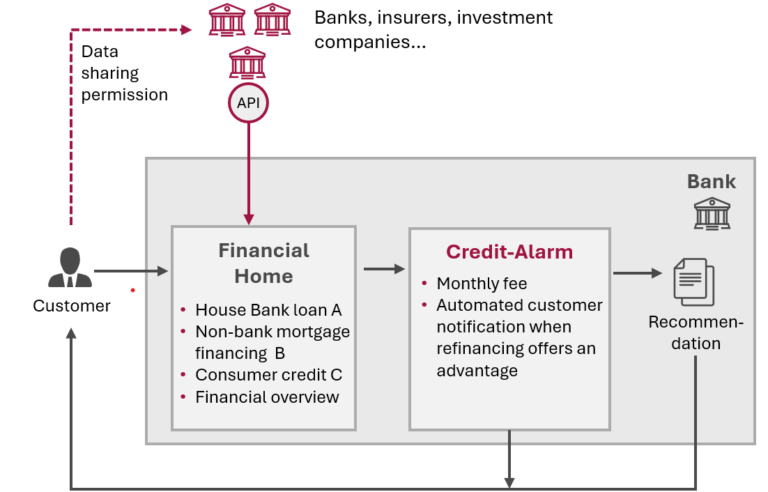

The second use case shows how FIDA is laying the foundation for new, data-driven services—with real added value for customers and new revenue potential for providers.

The challenge

Many banks offer standardized products in the retail sector, but these are not tailored to the individual circumstances of their customers. Another challenge is that customers in Germany – unlike in Italy, for example – are not willing to pay for account management (especially transfers and online banking). This means that the revenue opportunities in retail banking are limited to “traditional” banking products.

The solution

A “financial home” aggregates all of a customer’s financial data across banks – from accounts to loans and investments to insurance. Based on this previously inaccessible data, banks can now develop premium services that are precisely tailored to the needs of their customers.

Customers are willing to share more data and pay for premium services that offer them added value compared to the basic services they take for granted. This is clearly demonstrated by existing account models with tiered value-added services that cost up to €50 per month.

To illustrate this, we have developed the credit alarm use case:

For a small monthly fee, the system regularly and automatically checks whether the terms and conditions of a customer’s various in-house loans and loans integrated via the FIDA interface are suitable for aggregation and debt restructuring.

As soon as the customer’s bank can offer more favorable terms than those currently available externally, the customer is automatically informed and, ideally, can jump directly to the digital application process. This allows the customer’s bank to replace the non-bank loans and grant the customer an interest rate advantage at the same time.

Figure 2: Use case – Personalized premium services

The added value

The customer benefits from a more affordable, personalized offering, while the bank gains automated sales and a more comprehensive overview of financial data, enabling it to offer a new revenue model.

These two examples show how FIDA can create concrete added value—and why it pays to take action early. They also demonstrate the high potential of FIDA services and how important it is to take action early.

Conclusion: Act strategically now

Financial data access is more than just a regulatory milestone—it is an opportunity to actively shape your own role in the open finance ecosystem.

Those who invest early in technology, partnerships, and use case development will not only secure their regulatory position, but also tap into new sources of revenue, build an innovative service landscape, and increase customer satisfaction in the long term.

You must login to post a comment.