CRR III disclosure: Now comes the processing of Pillar III

The banks have worked hard and shown great commitment to meet the CRR III requirements for initial reporting by 31 March 2025. Our experience from the projects shows that the extension granted by the supervisory authorities for the submission of initial reports was absolutely necessary and had to be used in full. The focus now shifts to implementing the disclosure requirements.

True to the principle "Pillar III follows Pillar I", the disclosure requirements have also been revised with CRR III.

Extension of CRR III disclosure requirements

The revision of CRR III has resulted in far-reaching changes. In addition to the introduction of disclosure requirements for additional topics, existing requirements have also been expanded. Whereas in the past ESG disclosure requirements only applied to large institutions, these must now be met by all institutions. The reporting frequency for the content has also been revised, taking into account the principle of proportionality. The qualitative disclosures on ESG reporting in particular take up a large part of the resources.

Focus from the perspective of an authorized person

In addition to the content, the supervisory authority also takes the information needs of third parties into account. This represents a paradigm shift in provision. The provision of information in the freedom of the reporting party is now regulated centrally. The supervisory authority had observed that it was difficult for interested parties to determine the necessary information from the institutions and then compare it. The necessary degree of transparency was not provided from the perspective of the supervisory authority and objective comparability was not easy to achieve. In order to remedy this situation, all institutions, regardless of their size or portfolio, will have to transfer the information to be disclosed to a central data repository at the supervisory authority in future. As a single point of truth, third parties will be able to easily access and evaluate the disclosure information.

For the institutions, however, this means a certain amount of additional work for the implementation of the technical mapping and the procedural effort. Institutions must ensure that the information is synchronized if it has been published via different channels.

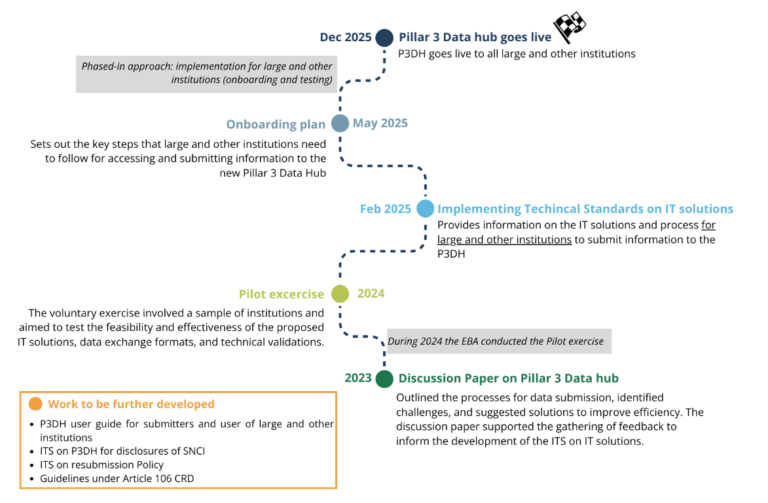

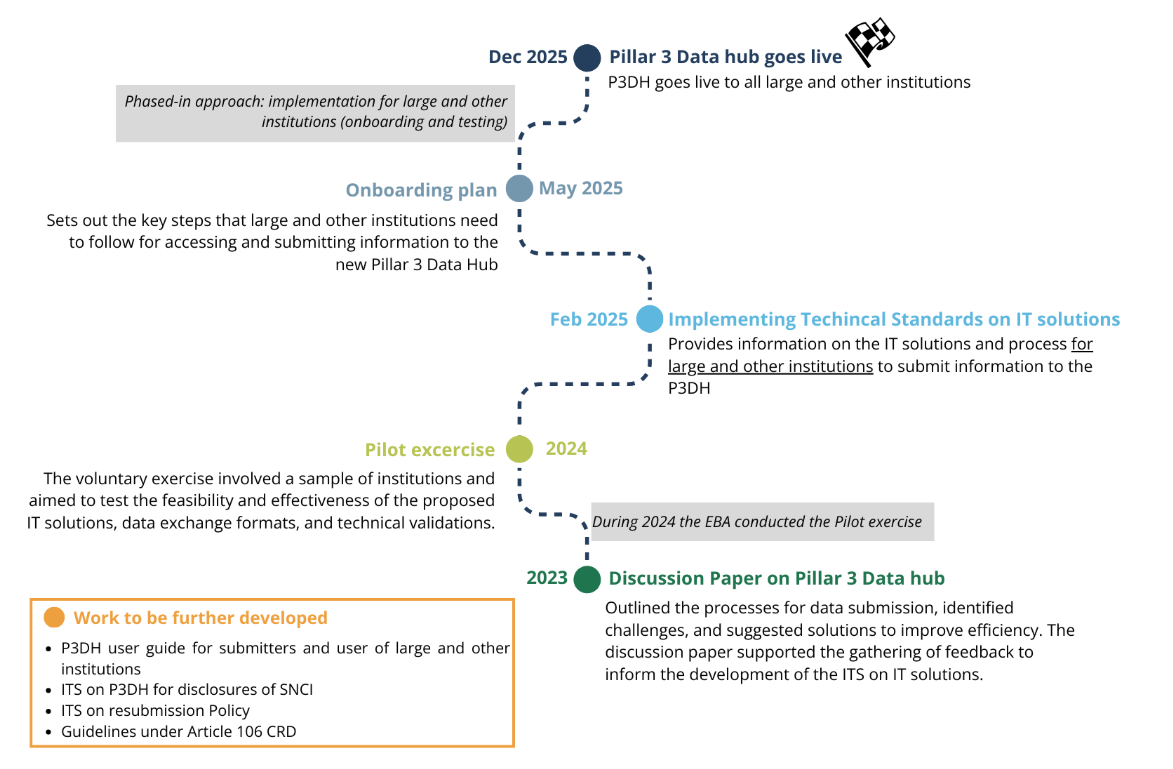

The supervisory authority is installing a Pillar 3 Data Hub for this purpose. However, implementation is still taking time, meaning that the supervisory authority still needs to provide further information on the established procedure. The go-live of the Data Hub will initially start for large institutions and for certain institutions classified as “other”. The supervisory authority’s roadmap is as follows.

Figure: roadmap towards the implementation of the pillar 3 data hub (Source: EBA1)

Disclosure requirements not yet finalized

As some of the requirements for Pillar 1 are still being finalized by the supervisory authority in the form of technical standards, disclosure is also still subject to change. Here too, technical standards of the supervisory authority are still open. In addition, the omnibus initiative also aims to reduce bureaucracy in order to ease the burden on SMEs. This may lead to a reduction in reporting templates.

You can get an insight into this in our article “EBA publishes draft amendment to ESG disclosure requirements – the principle of proportionality takes hold”.

Conclusion

The institutions are subject to further implementation requirements and simple disclosure is not possible. The resources available in the institutions continue to be challenged. This is exacerbated by the fact that the burden of follow-up work on the initial disclosures is not foreseeable. The implementation of disclosure should therefore not be put on the back burner.

Of course, we will also support you in this challenge with our technical and professional expertise.

CRR III - 360° View

The changes to CRR III affect all credit institutions and all risk types and have a far-reaching impact on overall bank management. We present the key changes and areas where there is a need for action.

You must login to post a comment.