Corporate Treasury in the Context of Interest Rate Changes and Currency Risks

Corporate treasury must record and manage cash flow-oriented financial resources for internal and external financing. In light of recent developments in interest rates and financial markets, we examine the challenges and opportunities associated with managing interest rate and currency risks in corporate settings. We illustrate how the strategic use of risk management instruments can make a tangible contribution to overall business performance.

Challenges and Opportunities in the Current Market Environment

Over the past three years, the interest rate environment has been marked by extreme volatility. Following a prolonged period of historically low interest rates, the European Central Bank (ECB) and the U.S. Federal Reserve implemented substantial rate hikes starting in 2022. This was followed by a pronounced shift toward rate cuts in the past year, which is now placing new demands on companies and their financing strategies.

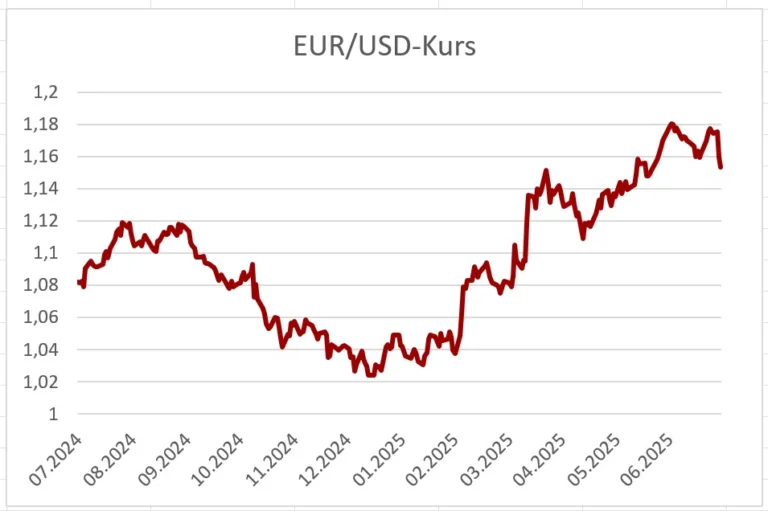

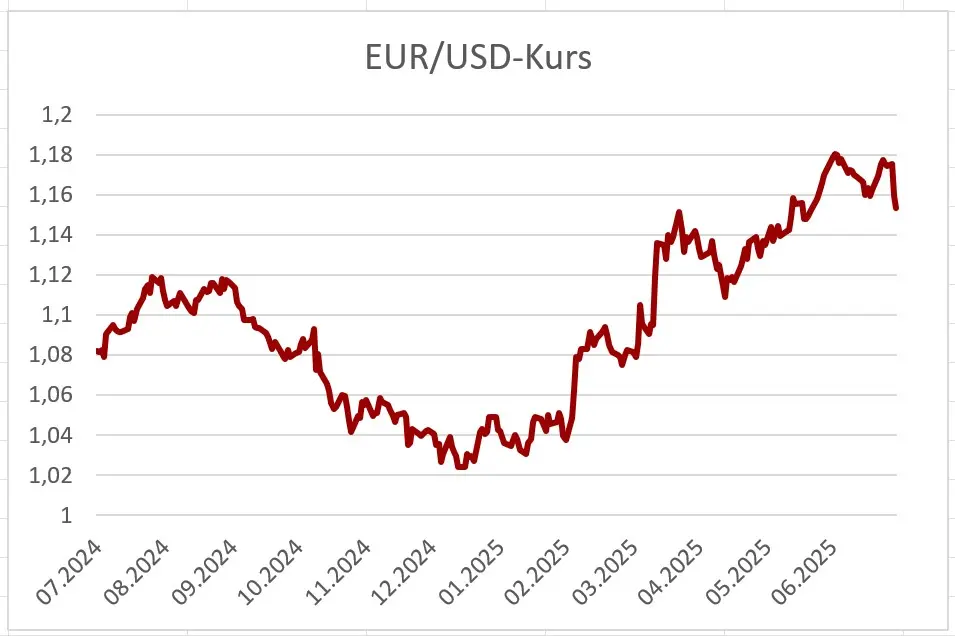

At the same time, the EUR/USD exchange rate has exhibited significant fluctuations for more than two years. In January 2025, the euro dropped to a low of approximately 1.03 before rebounding to around 1.18 by April. This volatility remains difficult to predict—particularly in light of the unpredictable U.S. trade policy under Donald Trump, whose presidency has had a significant impact on exchange rate developments.

Figure 1: Development of the EUR/USD exchange rate between July 29, 2024, and July 29, 2025 (source: market data provider SIX)2

In this context, active interest rate and currency risk management has become more important than ever for companies.

Exchange rate risks—particularly related to the EUR/USD rate—as well as interest rate risks have a direct impact on costs and margins.

The recent agreement between the U.S. and the EU on a new trade deal—which introduces a flat tariff of 15% on most EU exports to the U.S., while eliminating tariffs on U.S. goods deemed strategically relevant—offers some short-term predictability. However, developments in recent months have made it clear that exposures to the U.S. in particular must be actively managed and hedged.

Fundamentals: Interest Rate and Currency Risks in Corporates

Interest rate and currency risks are among the key financial risks faced by internationally active companies, particularly in an environment shaped by geopolitical tensions, volatile markets, and shifting trade relationships. Targeted risk management requires that these risks be precisely identified and delineated. The starting point is a thorough analysis of business models, cash flows, and capital structures.

Currency risks typically arise when a company conducts operating cash flows—such as procurement or sales—in a currency other than its functional accounting currency. The EUR/USD exchange rate is particularly relevant, as many commodities, technologies, and capital goods are invoiced in U.S. dollars. Contracts in emerging market currencies such as the Renminbi (CNY) or Brazilian Real (BRL) also carry additional uncertainties. In addition to transactional and translational risks, companies may also face economic currency risks, for example, through changes in competitive positions resulting from exchange rate shifts.

Interest rate risks primarily stem from financing or investment positions. These are especially relevant for companies with a high proportion of debt or substantial liquidity reserves. From an accounting perspective, a differentiated analysis is also necessary: under IFRS and German GAAP (HGB), interest and currency fluctuations can directly impact the income statement or equity, depending on the existence and structure of hedge accounting relationships. Precisely defining risk exposures and establishing proper reporting processes are therefore not only operational tasks but also strategic accounting issues.

Effective risk management starts with a systematic assessment and categorization of risks according to their operational, financial, and accounting origins. Based on this, companies can develop targeted hedging and control strategies, as outlined below.

Risk Hedging Strategies

Choosing appropriate strategies for hedging interest rate and currency risks is a central element of professional treasury management. The goal is not only to prevent losses but also to create planning certainty and actively manage financial flexibility. Every strategy must be built on a clear categorization of risks—whether transactional, economic, or accounting-related—and integrated into the company’s overall financing framework.

Currency management generally involves three strategic directions: transactional, economic, and balance sheet hedging. Transactional hedging targets specific foreign currency cash flows, such as those arising from import or export activities. It is typically executed using standard instruments such as forwards, currency options, or cross-currency swaps. Forwards lock in an exchange rate for future payments, while options offer more flexibility—for instance, when companies want protection against losses but still wish to benefit from favorable market movements.

Economic hedging addresses structural risks, focusing not on individual transactions but on a company’s overall competitiveness, particularly in the face of prolonged exchange rate movements. Common approaches include natural hedging—balancing inflows and outflows in the same currency—or relocating production sites to foreign currency regions.

Balance sheet hedging focuses on foreign currency positions within consolidated financial statements, such as net investments in foreign subsidiaries. A balance sheet hedge can be implemented, for example, via intercompany financing in the respective foreign currency.

Several strategies are also available for managing interest rate risks. The central question is how companies can protect themselves against future interest rate increases or declines. Standard instruments include interest rate swaps, which convert variable-rate obligations into fixed-rate ones, as well as interest rate caps and floors, which define a range and offer more flexibility. Swaptions (options on swaps) allow companies to respond to expected interest rate movements without committing immediately.

In practice, an integrated and portfolio-based approach is recommended, in which interest rate risks are managed across all financing positions. Methods such as gap analysis, duration matching, and value-at-risk calculations support a quantitative control framework aligned with the company’s risk tolerance and market outlook.

A key success factor for any hedging strategy is its integration into the broader treasury and corporate strategy. Clear hedging policies—defining quotas, maturities, reporting, and documentation requirements—form the backbone of a professional approach. In addition, measures must be aligned with accounting regulations (e.g., IFRS 9 or Part Three of the German Commercial Code) to avoid balance sheet volatility and ensure hedge effectiveness in accordance with hedge accounting standards.

Selecting the Right Hedging Instruments

The selection of appropriate instruments to hedge interest rate and currency risks depends on the company’s individual risk profile as well as regulatory, accounting, and economic considerations. Key criteria include the volume of exposure, its maturity, and accounting treatment under IFRS or German Commercial Code.

While standardized forwards and options are suitable for smaller or short-term exposures, larger or longer-term risks often require structured derivatives such as swaps, swaptions, or collars (which define both a minimum and maximum interest rate). The choice of instrument also depends on the desired degree of flexibility and the associated cost.

It is also essential that the hedging strategy be embedded within the company’s treasury policy. This policy should clearly define permissible instruments, hedging ratios, and decision-making processes. Treasury management systems (TMS) play a supportive role by enabling transparent, auditable implementation.

Ultimately, instrument selection is not a one-time decision. It requires ongoing review and adjustment to reflect changing market conditions and evolving corporate objectives.

Recommendations for companies

Regardless of size, companies must take a systematic approach to managing interest rate and currency risks. What matters is a pragmatic setup aligned with available resources and capabilities. Risk identification and monitoring should be established as a continuous process, supported by simple tools or external partners where needed.

Larger companies often benefit from more comprehensive governance structures. In contrast, mid-sized companies can achieve efficiency with leaner solutions: treasury functions do not necessarily need to be housed in a dedicated department, but can be effectively integrated into existing finance or accounting teams. A formal treasury committee may not be required; central decisions can be pragmatically coordinated and documented at the management level.

Simple hedging guidelines and standardized instruments help streamline operational implementation. While technological tools such as TMS or specialized applications can be helpful, they are not mandatory. Regular training and a basic understanding of financial markets and risk exposures are also essential.

External advisory support can add value—particularly when validating existing processes or implementing new instruments. What matters most is treating treasury not as a niche discipline but as an integral part of a robust financial strategy.

Conclusion and outlook

The market environment of recent quarters has clearly shown that interest rate and currency risks have regained significance for companies of all sizes. The era of stable conditions has ended, disrupted by monetary policy turning points, geopolitical tensions, and new trade frameworks such as the latest U.S.-EU tariff agreement.

Companies should therefore regularly assess their risk exposures, develop appropriate hedging strategies, and integrate them into their financial processes—tailored to their specific capacities and organizational structures. Treasury functions can be lean and pragmatic, embedded within broader financial operations.

Most importantly, active risk management not only helps contain risk but also opens up new degrees of freedom. A well-structured treasury function can thus make a measurable contribution to corporate success.

We support you with a comprehensive service portfolio:

- Customized treasury management aligned with strategic initiatives and business objectives

- Analysis and optimization of liquidity, financing, and investments, including cash flow management and financing concepts

- Development of tailored hedging strategies and support in ensuring regulatory compliance

- Selection, implementation, and optimization of treasury management systems, automation, and access to relevant market data

Regardless of your company’s size, we collaborate with you to design a tailored treasury management framework that strategically anticipates challenges, minimizes risks, and safeguards your financial flexibility.

Sources

-

1. finanzen.net

-

2. Market data provider SIX

-

3. See also: Cerryl P. Stember, Oliver Führers: Cash management - a holistic approach in Birrer, Rupp and Spillmann (eds.): Corporate Treasury Management, 2018

You must login to post a comment.