Implementation of the Consumer Credit Directive 2026

The government draft bill for the implementation of the Consumer Credit Directive (EU) 2023/2225 has been available since 3 September 2025. The scope of the previous general consumer loan law is being expanded to include, among other things, the regulation of "buy now, pay later" schemes.

Background

The government draft for the implementation of the Consumer Credit Directive (EU) 2023/2225 has been available since 3 September 2025. The aim of the Consumer Credit Directive is to ensure a high level of consumer protection, promote the internal market for consumer credit and at the same time take account of UN Sustainable Development Goals 1 (“End poverty”) and 12 (“Sustainable production/consumption”). The implementation ensures that Germany complies with the new European consumer protection standards.

To summarise, the scope of application of the existing general consumer loan law will be extended, the mandatory creditworthiness check to be carried out before the contract is concluded will be tightened and other existing provisions for real estate consumer loan agreements will be transferred to general consumer loans. Newer (digital) forms of credit such as “buy-now-pay-later” and thus (apparently) free loans are also covered by the regulation in Section 506 BGB-E (German Civil Code) for the first time, as the deferred payment is to be treated as a short-term loan.1, 2

Overview of the most important changes

The most important changes are summarised below.

- Inclusion of new forms of credit, in particular the aforementioned free forms of credit

- Stricter creditworthiness assessment: credit may only be granted if repayment is likely (which raises the question of quantifiability).

- Mandatory offer of forbearance measures: Keyword debt rescheduling

- Stricter regulation of overdraft facilities: the bank must observe a notice period of 30 calendar days in accordance with Section 504 (2) of the German Civil Code (BGB), and the overdraft facility may be repaid in twelve equal monthly instalments.

Please note that the comments in this article refer to the government draft. The final version is likely to differ from this. On 3 November 2025, the Committee on Legal Affairs and Consumer Protection held a public hearing on the government draft. As expected, the lobby representatives from the banking/insurance side are calling for the provisions to be toned down and the consumer advocates for them to be tightened up.

Nullity of general consumer loan agreements

Section 492 (9) BGB codifies the BGH case law on immorality. Accordingly, a general consumer loan agreement will in future be null and void if its effective annual interest rate is more than double the comparable standard market loan or exceeds it by twelve percentage points in absolute terms. Consequently, the average interest rate of the loans granted is used as a benchmark. Here, the unethical outliers should actually be eliminated in advance – however, these can only be found once the average is available. The absolute consideration, i.e. the difference between the actual effective interest rate of the loan and the comparative interest rate, will only be relevant in practice if the interest rate level is very high.

Clarification on early repayment penalties

As is generally known, Section 490 (2) BGB refers to the early cancellation of fixed-interest loans secured by land or ship liens if the borrower has a legitimate interest. § Section 500 (2) BGB, on the other hand, allows early repayment of consumer loans with fixed-interest agreements, which is easier compared to section 490 (2) BGB (no obligation to provide security under land or maritime lien law; no legitimate interest). § Section 500 (2) BGB relates to consumer loans and is therefore lex specialis in comparison to the general provision in section 490 (2) BGB. In this respect, section 500 (2) sentence 2 is only supplemented for clarification purposes:

If the conditions for early repayment are met, section 490 (2) shall not apply.

Cost reduction according to § 501 BGB

Section 501 (1) BGB is revised as follows:

(1) If the borrower fulfils his obligations under a consumer loan agreement prematurely in accordance with Section 500 (2), the total cost of the loan shall be reduced in accordance with the remaining term of the agreement. (...).

In future, the cost reduction would therefore apply to all costs, not just term-dependent costs. This requirement would therefore also cover the processing fee that is not term-dependent. However, in view of the case law of the Federal Court of Justice (BGH), which led to the prohibition of processing fees almost across the board (BGH 13 May 2014, XI ZR 405/12 and XI ZR 170/13), the practical relevance is very low.

The cost reimbursement requirement is not self-explanatory and will therefore be explained using an example. In principle, the settlement of loans that have been repaid or called in early does not pose any problems, as the borrower must pay the unpaid loan amounts plus any pro rata interest for the period from the last instalment payment to the settlement date. Any early repayment penalty must be considered separately.

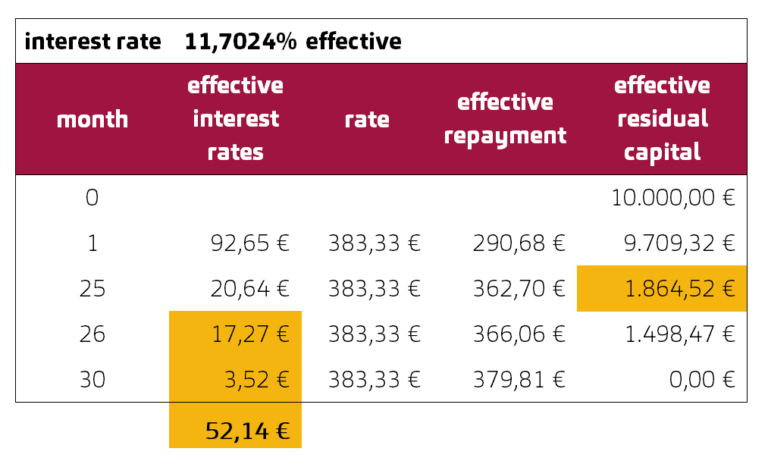

The situation is different for special instalment loans, which are now rare and used to be called term interest loans or p.m. loans. In the case of early repayment, it is not possible to simply claim the instalments still outstanding as scheduled, as otherwise the borrower would also have to pay interest on capital that is no longer used. Therefore, the term-dependent loan costs that are not “used up” must be deducted from the sum of the scheduled outstanding instalments. Example: Loan amount €10,000; monthly interest rate 0.5%; 30-month term; monthly instalment therefore €383.33.

The remaining debt is then to be reduced by the amount of the outstanding monthly instalments by the interest saved, which is to be calculated on a sliding scale. As § 501 BGB expressly refers to the PAngV, this suggests the graduation with the effective annual interest rate. The interest deemed unutilised at the assumed repayment date after 25 months is calculated as follows. The effective or comparison account according to PAngV results in a capital balance of €1864.52 after 25 instalments (see figure in extracts). The interest deemed to have been saved amounts to € 52.14, which is the effective interest still outstanding. The bank customer therefore pays the outstanding instalments (5*383.33 €) of 1916.65 € less the interest subsidy of 52.14 €. He therefore still pays €1864.51 and thus the remaining debt shown in the effective account. The same result is reached on the basis of the nominal interest rate p.a. (11.118 %). The practical relevance of Section 501 of the German Civil Code (BGB) is therefore still only given in very exceptional cases, as the residual debt already corresponds to the difference between outstanding instalments and reimbursed interest.

Figure: Installment loan and early repayment

Forbearance measures

Section 497a BGB-E provides, among other things, for the institution to refer borrowers who are unable to meet their financial obligations to debt counselling services. The lender must exercise reasonable forbearance before initiating enforcement proceedings in connection with a general consumer loan agreement. Reasonable forbearance may consist of a full or partial rescheduling of the loan. According to the draft law, numerous contractual adjustments can be considered, which from the bank’s point of view are typically dubbed extraordinary events:

- Extension of the term,

- change in the type of loan agreement,

- deferral of all or part of the instalments in a given period,

- reduction of the debit interest rate,

- interruption of payments,

- partial repayments,

- currency conversions,

- a partial waiver and a debt consolidation.

The introduction of the above measures, which can also occur in combination, usually leads to a change in present value for the institution, which can be precisely quantified with the help of MARZIPAN. Consequently, the disadvantages (or advantages) of the measures can be quantified within the bank. However, financial disadvantages of the measures taken cannot be passed on to the borrower. On the other hand, this is likely to be less of a problem if the borrower gets into difficulties, as there is a risk that the residual claim will not be recoverable.

European standard information for consumer credit

The information must be provided pre-contractually.

They result from Annex 1 (to Article 23 No. 6); Annex 4 (to Article 247 § 2 EGBGB-E) of the government draft.

Key information (if applicable):

- Lender; credit intermediary; total amount of credit; duration of the credit agreement; borrowing rate or the various borrowing rates applicable to the credit agreement; annual percentage rate of charge; if applicable: credit in the form of deferred payment with description of the goods/services, cash price; costs in the event of late payment with applicable interest rate and arrangements for its adjustment and, if applicable, calculation of late payment costs.

- Instalments and, if applicable, the order in which the instalments are credited; warning about the consequences of non-payment or late payment; right of withdrawal.

- Early repayment with information that the lender may then be entitled to compensation; address and contact details of the lender and, if applicable, the credit intermediary.

Conclusion

Consumer protection also extends to newer forms of credit such as buy-now-pay-later. The requirements for creditworthiness checks are increasing, but above all the requirement to exercise forbearance before foreclosure is leading to new requirements in the lending business. Nevertheless, the economic consequences of a debt rescheduling measure can already be easily determined using the standard MARZIPAN software.

Overall, the implementation of the directive will involve considerable effort for the institutions (including process adjustments and the need for legal clarification).

Sources

-

1. Cf. Federal Ministry of Justice and Consumer Protection, press release: More consumer protection for credit agreements: BMJV publishes draft law to implement the Consumer Credit Directive, 23 June 2025

-

2. See Federal Ministry of Justice and Consumer Protection, Infopaper: Implementation of the new EU Consumer Credit Directive - Draft Law, September 2025

-

3. Article 2 = Amendment to the Introductory Act to the German Civil Code

You must login to post a comment.