Collections

Finance, Risk, Regulatory Reporting & Compliance

The financial world of the future requires smart, digital solutions. Complex industry-specific, business and regulatory requirements are accelerating the development of financial institutions to ensure consistency between regulatory reporting, risk management and compliance. These areas will no longer be separated in the future. Instead, they will be aspects of integrated bank management. Integrated, networked solutions and modern cloud services that reflect both the complexity of each individual topic and the consistency between topics will therefore be essential for managing a bank in the future. In our series ‘Finance, Risk, Regulatory Reporting & Compliance’ we present the latest developments.

Payments

New standards, innovations and changing customer needs are reshaping the market and infrastructure. Groundbreaking trends and developments, whether in traditional retail and mass payments or in innovative technologies such as the Internet of Things (IoT), blockchain and the cloud, are creating challenging tasks for financial institutions. In this collection, our experts and authors take an indepth look into the topic ‘Payments’ and summarise the most significant insights for you. Dive in and discover the latest developments in payment transactions.

Sustainable Finance

Sustainability has become an integral part of the banking industry. Initiatives by legislators and regulators are driving this development. However, customers are also increasingly focusing on sustainable, environmentally friendly, and climate- and resource-saving aspects when making financial decisions. To ensure long-term economic success and overcome regulatory hurdles, banks must align their business activities with sustainability goals at an early stage and be prepared to deal with sustainability risks. What is the best way to prepare for a sustainable future in the banking industry? What requirements need to be met? In this archives you'll find all answers and information needed regarding the topic "Sustainable Finance".

Banking of the Future

The future of banking has already begun. From online banking and mobile payment methods to cryptocurrencies, the financial sector has had to face major changes time and again in recent years. And disruptive change continues to advance. The main drivers are the use of artificial intelligence, the expansion of platform economies and the penetration of fintechs into traditional banking services. This disruption is redefining the rules of the game for an entire industry. How must banks position themselves NOW in order to be prepared for the challenges of the future? This question is the focus of our series Banking of the Future.

Banking Customer Interactive Solutions

In times of dynamic markets and heterogeneous target groups, customer experience has become a key strategic task for banks and insurance companies. Building and maintaining long-term customer relationships through positive customer experiences is crucial for sustainable business success. In this series, our experts highlight how companies are mastering these challenges and what approaches, opportunities and potential lie in an optimised customer experience.

Artificial intelligence (AI)

Discover the future of banking: AI technologies are revolutionising the industry. From personalised recommendations to fraud detection, learn how artificial intelligence is making financial services more secure, efficient and customer-centric. Immerse yourself in the world of innovation and experience banking like never before.

Financial Data Access (FIDA) & Open Finance

The European Open Finance Regulation FIDA presents both opportunities and challenges for the financial industry. The opening up of a wide range of customer-related data – from investment and credit products to insurance – goes far beyond PSD2. For financial institutions, this means preparing existing data, participating in data access schemes, providing interfaces and implementing new operational processes. However, FIDA also implies further development of their own business models, use of data for optimised customer offers and new competitive options. The articles listed here are intended to help you classify, implement and take advantage of FIDA – in order to shift the cost/benefit ratio of the regulation in your favour.

Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act (DORA) sets new standards for the digital resilience of financial service providers from 2025 onwards. Technical adjustments and far-reaching strategic and organisational changes are required to ensure protection against cyber risks and to meet regulatory requirements. In this series, our experts shed light on how companies can overcome these DORA challenges and which strategies are effective.

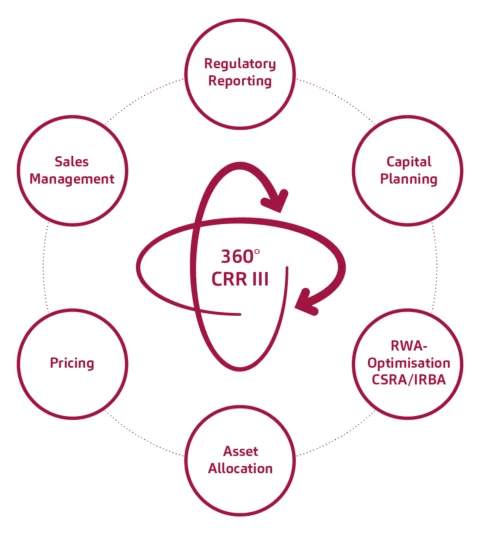

CRR III - 360° view

The revision of the Capital Requirements Regulation (CRR) will bring some significant changes from 2025 onwards that will affect all credit institutions and all types of risk. With a 360° view, we shed light on all the implications of this reform – from capital planning, which already extends beyond the date of application, to asset allocation, pricing and sales management to reporting requirements. You can find the latest articles on this topic here.