Shortage of skilled workers in banking: strategies for board level

The shortage of qualified employees is a reality – and cannot be solved by artificial intelligence (AI) alone. The future will be based on the right mix of technology and employees with new skills. This article discusses how board members can prepare for this now.

- The future of banking: familiar to people - and technologically strengthened

- How serious is the situation?

- Definition of a future operating model

- Impact on employee development - what role do skills and talent strategy play?

- Training and further education as a strategic success factor

- Conclusion and outlook

- Sources

The future of banking: familiar to people – and technologically strengthened

The fact that digital transformation must have the highest strategic priority has long been undisputed at Management Board level. The increasing integration of AI technologies will further accelerate this change – across all functional areas.

However, despite agreement on the necessity, one key question remains unanswered:

What will the optimal operating model for a bank look like in five or ten years, and what strategic areas of action will this result in?

Despite all the digital possibilities, the majority of customers still prefer to go to the branch.1 Particularly when it comes to complex, trust-intensive topics such as investment advice, real estate financing or retirement provision, personal contact usually remains the first choice, regardless of income or financial circumstances.2

The future of banking is not purely digital – it is technologically supported, human-based and built on trust. This means that the quality of employees remains an important pillar for the success of any bank.

How serious is the situation?

The importance of qualified employees remains high – but the shortage of skilled workers in the banking sector continues to worsen. The main reasons for this are demographic change, waves of retirements and declining numbers of trainees.

The facts are clear:

- Around a third of employees in the banking sector will retire in the next ten years.3

- More than 38,000 positions at banks and FinTechs are currently vacant.3

- 78 % of the management boards of the Volksbanken and Raiffeisenbanken cite the shortage of skilled workers as the most important driver for mergers.4

The industry is therefore facing a structural challenge – which can only be overcome with clear strategic personnel planning. As a result, many decision-makers are hoping for a significant increase in productivity through the use of technological components. However, there is often a lack of a clear strategy as to which technology best supports employees so that synergies can be realized in the long term. Another danger is the so-called lock-in effect. This refers to a situation in which the bank no longer has qualified employees who can decide whether the results of the AI are right or wrong, as certain areas have been left entirely to the technology.

What is often missing is a clear target picture of the operating model with which the bank will operate in the next 5 to 10 years.

Definition of a future operating model

Strategic HR planning requires banks to be aware of their future employee requirements. This is inevitably derived from the bank’s target image for the future, which must answer key questions:

- What will be my core competencies that can only be done by employees?

- Which functions can be performed more efficiently with the help of technology?

- Which functions can I outsource partially or completely?

Each bank will have to answer these questions individually.

However, some trends in this regard can already be identified:

Core competence of employees:

Banking transactions remain a matter of trust in many areas, especially when it comes to major decisions that are important for private and corporate customers. This is why personal contact will continue to be crucial in the future. Key positions in management, sales and compliance will also be important. However, in order to be successful in their roles, they will need a strong understanding of AI and other technological trends and must be trained accordingly. AI tools should be seen as a supplement to day-to-day operations so that repetitive tasks can be automated or supported.

Opportunities to increase efficiency:

Strongly process-driven functions, such as document or data management, benefit from AI and other technologies. The initial regulatory considerations to simplify the rules, especially for small and medium-sized banks, will provide additional relief here.

Room for outsourcing:

There is potential for outsourcing in all areas that are not part of the bank’s core competence but benefit from economies of scale. This could be the case above all in the area of IT applications or certain reporting functions.

Impact on employee development – what role do skills and talent strategy play?

Based on the above, it is clear that traditional bank training is no longer sufficient to prepare employees in depth for their new tasks and roles. In addition, innovative further and advanced training measures are required in order to stand out on the employer market.

The following approaches should be examined and evaluated on an institution-specific basis:

- Employer branding: Banks can counter the shortage of skilled workers at an early stage through targeted recruiting and training measures. However, “new ways” around new work topics, incentives and attractive further training measures are necessary in order to assert oneself in the “war for talent”.

- Employee pooling: Temporary exchange of specialists between institutes in the event of bottlenecks.

- On-demand talent models: external expertise can be booked flexibly (“freelancer-as-a-service”).

- Flexible working models: part-time, job sharing, remote work – particularly attractive for Generation Z.

- Cooperation with start-ups and FinTechs: access to innovation, agile thinking and new skills.

- Global recruitment: foreign specialists fill staff gaps.

Training and further education as a strategic success factor

Recruiting trainees is a key success factor for the future viability of companies. Well-trained junior staff are not only the specialists of tomorrow, but also help shape the culture and change within the company during their training. High-quality training is based on personal support, clear structures and targeted exam preparation. Promoting social and personal skills also strengthens both the quality of training and long-term loyalty to the company. This bond can be strengthened beyond the apprenticeship – for example by working part-time or on a mini-job basis while studying. This maintains contact with practice.

Innovative career guidance is needed to attract talent at an early stage: short taster placements, one-day internships and a presence at schools and training fairs create low-threshold entry points and valuable networks. With these measures, banks not only secure the next generation of skilled workers, but also strengthen their position as an attractive training company.

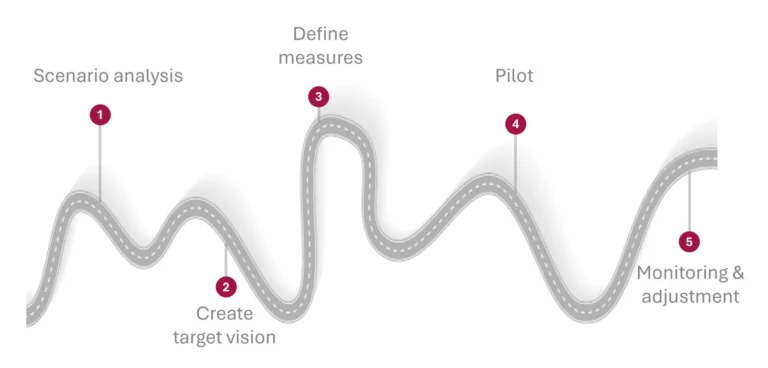

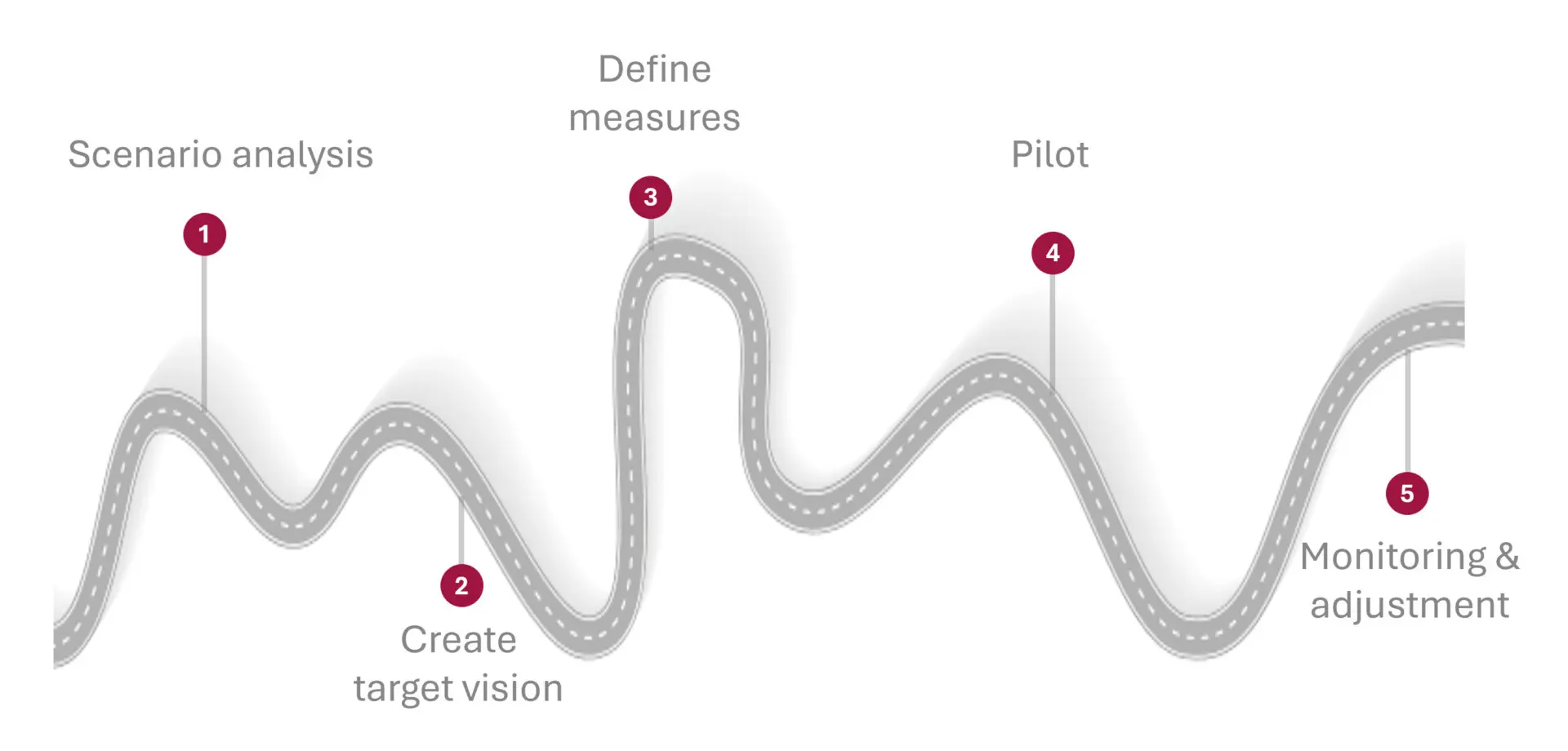

What is the best way for banks to proceed? The following roadmap provides some pointers.

Figure: Roadmap for securing the future: Step-by-step implementation

- Scenario analysis

- Which roles and processes are critical, which can be taken over or outsourced by AI?

- Create target vision

- What skills and roles will be needed in five years’ time?

- What are the bank’s overarching goals and vision?

- Which personnel and skills are required to achieve the goals?

- Define measures

- Investment in further training (e.g. ESG, AI, data skills, leadership).

- Build talent pools and evaluate lateral hiring programs.

- Pilot and scaling

- Start with pilot projects (e.g. AI-supported back office process), subsequent rollout strategies.

- Monitoring and adjustment

- KPIs: Time to fill, training rate, turnover rates, ROI of AI projects.

Conclusion and outlook

The shortage of skilled workers in the German banking sector is profound: tens of thousands of vacancies, an ageing workforce and declining numbers of trainees characterize the situation. At the same time, the pressure to transform business models and leverage efficiency potential is increasing.

Artificial intelligence offers enormous potential here – particularly in routine processes, service automation and internal efficiency improvements. But AI alone will not solve the problem.

The key lies in a hybrid-strategic approach that intelligently combines

- targeted further training,

- systematic talent development,

- flexible employment models and

- technological integration.

This is the only way to not only mitigate the shortage of skilled workers, but also to use it as a catalyst for modern, future-proof structures.

Would you like to identify specific measures for your institute or learn about best practice approaches? Then please feel free to get in touch with us.

Sources

-

1. Bitkom, Digital Finance 2024

-

2. Atruvia, Changing customer interaction in tomorrow's banking - significance for banks, bank advisors and customers, August 2023

-

3. Handelsblatt, German banks record strongest increase in employees for decades, 25.06.2025

-

4. Genoverband e.V., Political debate: What helps against the shortage of skilled workers?, 26.01.2025

You must login to post a comment.