Mastering transformation risks – people as the decisive factor for success

Banks are undergoing constant change. However, employees play a crucial role in ensuring that transformation projects (such as mergers) are implemented successfully. The following article explains how they can become the key to success.

- The pressure is growing: Banks undergoing change

- Mergers as challenges

- Transformation is more than just a structural project

- Change management: the art of shaping change

- New demands on leadership: from instructing to empowering

- From concern to participation

- Recommendations for decision-makers in banks

- Transformation is a cultural project

The pressure is growing: Banks undergoing change

The banking landscape is undergoing constant change. Technological progress, changing customer expectations, regulatory requirements and, above all, increasing cost pressure are forcing many institutions to restructure or undergo far-reaching transformations. In addition, there is a growing staff turnover: experienced employees are leaving the sector due to attractive offers from competitors, among other things, and there is a lack of young talent at a time when expertise and a willingness to change are particularly in demand.

Mergers as challenges

For many banks, mergers are seen as an obvious solution to counter increasing cost pressure. In Germany, too, the momentum for consolidation is increasing noticeably, as Helaba’s current plans to take over Aareal Bank show. The aim is to exploit economies of scale, streamline structures and leverage synergies. But as necessary as they may seem from a business perspective, they are risky to implement.

Anyone who thinks about transformation only in terms of numbers fails to recognize the reality of human needs.

Transformation is more than just a structural project

During a transformation and especially in the context of mergers, it is not just systems and processes that collide, but also corporate cultures, identities and habits. This often means uncertainty for employees: “Will I still be needed? Will my location remain the same? What will become of my team?”

These fears are not a side issue. They determine the success or failure of a transformation. Studies show:

Up to 70% of all change projects fail not because of the strategy, but due to a lack of acceptance by employees.

Typical fears of bank employees during mergers include:

- Job loss: synergy effects often lead to staff cuts, which creates massive pressure

- Loss of identity: employees are proud of “their” bank and “their” name. A merger can be perceived as a loss of home.

- Uncertainty due to new structures: New management models, unfamiliar processes, changed work locations or methods leave many at a loss.

- Lack of information: Rumors spread faster than facts. Lack of transparency creates resistance.

Change management: the art of shaping change

If you want to successfully transform or merge a bank, you have to focus on people.

Change management is not an appendage to strategy, but a prerequisite for it. Many managers are aware that “softer” factors such as culture, communication and co-design play a central role. Nevertheless, their influence on the company’s success is often underestimated, not least because they are difficult to measure and often lose out to “hard” key figures such as turnover or returns.

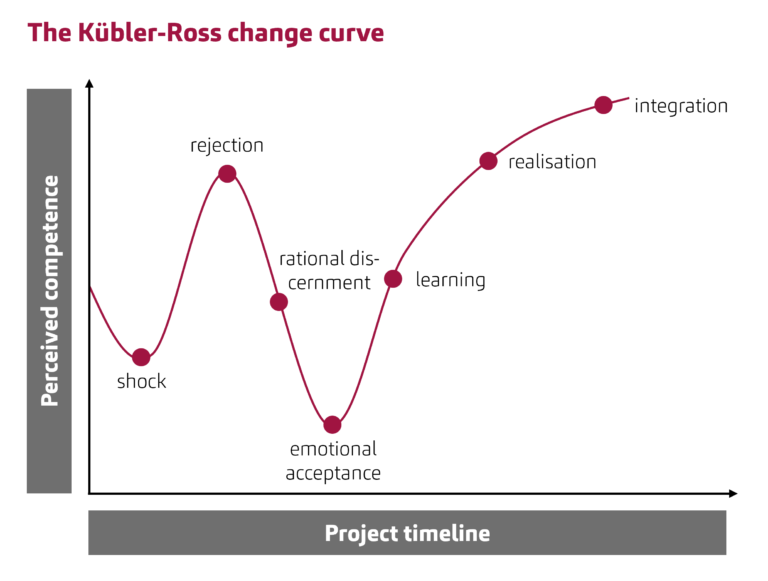

Understanding change: The Kübler-Ross change curve

The following diagram helps us to better understand the emotional dynamics of employees.

Figure: The Kübler-Ross change curve

This model shows which psychological phases people typically go through when they are confronted with far-reaching changes: from shock and denial to resistance and frustration to acceptance and integration. For a successful transformation, it is crucial not to see these emotional reactions as resistance to the strategy, but as a normal reaction to uncertainty and loss of control. Managers and change teams should provide targeted support when employees are at an emotional low, i.e. in the trough of the curve. Only those who take these phases seriously and support them according to the respective needs will create the conditions for sustainable change and new motivation.

Concrete success levers:

- Early and honest communication: Don’t just present ready-made decisions, but acknowledge uncertainties and shape the path together.

- Transparency about the goals and benefits of the merger: Employees need to understand what the change is for – and what they will actually gain from it.

- Create participation formats: Workshops, feedback rounds, dialog formats at eye level promote acceptance and innovative strength.

- Actively involve employee representatives: They are important multipliers and anchors of trust in times of change.

- Enable individual support: Coaching, training and psychological support help to reduce fears and develop new skills.

Based on the above, the respective leadership role is of immense importance.

New demands on leadership: from instructing to empowering

In the course of New Work, expectations of managers have changed fundamentally and therefore also influence the likelihood of successful transformations. While authoritarian or hierarchical leadership styles used to dominate, empathic, participative and agile leadership approaches are in demand today. Employees no longer just expect instructions, but orientation, meaning and space to help shape things. In a transformation, especially in the context of a merger, managers need the ability to endure uncertainty, create psychological security and guide heterogeneous teams through change.

Transformation can only succeed if managers not only implement strategies, but also take people with them. This requires a new attitude: away from “command & control” and towards “coach & connect”. Leadership thus becomes the key multiplier for willingness to change, trust and innovative strength in the company.

From concern to participation

Change is here, the decisive factor is how banks shape it.

Transformations can be an opportunity for realignment and strengthening if they are understood as a joint project. However, employees must be transformed from objects to subjects of change. This is not achieved through top-down communication, but through active listening, co-creation and active appreciation.

Recommendations for decision-makers in banks

- “People First” principle: Transformation begins in the minds of employees. Cultural integration is just as important as technological integration.

- Build up change expertise early on: Specialized change teams with clear responsibilities must be involved at an early stage.

- Develop managers as role models: Without genuine buy-in from leadership, transformation remains lip service. They must convey security, lead with empathy and set a credible example of change.

- Enable ownership among employees: Change succeeds when employees experience themselves as active shapers. Clear roles, transparent communication and genuine participation formats promote commitment, responsibility and identification with the change.

- Take feedback seriously and integrate it: Regular employee surveys and feedback loops help to identify points of friction at an early stage and adapt the process flexibly.

- Make successes visible and celebrate them: Visible recognition of milestones promotes motivation, creates momentum and strengthens confidence in the change process – at all levels

Transformation is a cultural project

Transformations are not only driven by economic or technological factors. They also require a profound cultural change within the organization. Uncertainty can only be turned into confidence and resistance into the will to shape the future if managers consistently involve their employees. Employees are not an obstacle, but a key success factor.

You must login to post a comment.