Climate risk stress test for the German banking sector: analysis of a current model approach

The ECB uses climate risk stress tests to assess how well banks are prepared for the risks associated with climate change. A team of authors from the Deutsche Bundesbank has published a research paper setting out a new framework for climate risk stress tests. We present the model approach, examine it from a practical perspective, and show how key elements can be combined with a lean and practical procedure developed by msg for banking.

Climate change is one of the greatest challenges facing politics, the economy, and financial systems worldwide. Particular attention is being paid to transition risks—risks arising from the political, technological, and economic shift to a low-carbon economy.

Against this backdrop, a research team at the Deutsche Bundesbank, consisting of Christian Gross, Laura-Chloé Kuntz, Simon Niederauer, Lena Strobel, and Joachim Zwanzger, has developed a climate risk stress test model that analyzes the vulnerability of the German banking sector to a green transition. The authors present their methodological approach and findings in the discussion paper “Climate stress test for the German banking sector: Impact of the green transition on corporate loan portfolios” (Deutsche Bundesbank Discussion Paper No. 11/2025, hereinafter referred to as Gross et al. (2025))1.

A dual model approach: micro and macro model

The climate risk stress test approach developed by Gross et al. (2025) is based on a model framework that combines macroeconomic aggregate data with microeconomic firm data to quantify the impact of climate-related transition risks on the probability of default (PDs). The paper treats the macroeconomic and microeconomic approaches in parallel and compares the results in terms of their consistency, focusing in particular on aggregated trends and sectoral heterogeneity.

The micro model uses panel data regressions at the individual company level to estimate PDs as a function of key balance sheet ratios such as equity ratio, debt ratio, liquidity ratio, interest expense ratio, and return on assets (ROA). So-called bridge equations translate the influence of external macroeconomic climate scenarios – such as a rise in CO₂ prices – into changes in these original microeconomic indicators. Company-specific emissions data are particularly relevant here, as they have a decisive influence on the level of costs induced by climate policy. By linking balance sheet structure and emissions profile, heterogeneous risk profiles within a sector can be mapped in detail.

The proposed macro model uses an autoregressive distributed lag model supplemented by Bayesian model averaging. It estimates sectoral PD developments based on historical relationships between macroeconomic variables—such as gross domestic product, unemployment, interest rates, inflation, stock prices, and CO₂ prices — and observed default rates. The combination of numerous model specifications reduces uncertainty and enables robust extrapolation.

Data basis

Gross et al. (2025) draw on an extensive and heterogeneous database for both approaches. The microeconomic analysis comprises data from around 17,900 companies (non-financials) and is based on annual financial statements supplemented by emissions data.2 Company-specific PDs – which serve as the dependent variable in the micro model and as an aggregated target variable in the macro model – are taken from the Bundesbank’s credit register.

Gross et al. (2025) use the following independent variables to estimate the macro model: real GDP, unemployment rate, short- and long-term interest rates, inflation, share prices and the CO₂ price. The company-specific PDs are aggregated on a volume basis at sector level (NACE Level 2) and used as the target variable in the econometric estimates.

Key results of the climate risk stress test

The risk simulations carried out in the research paper are based on two scenarios:

A long-term Net-Zero-2050 scenario from the Network for Greening the Financial System (NGFS), which assumes an orderly transition to climate neutrality.

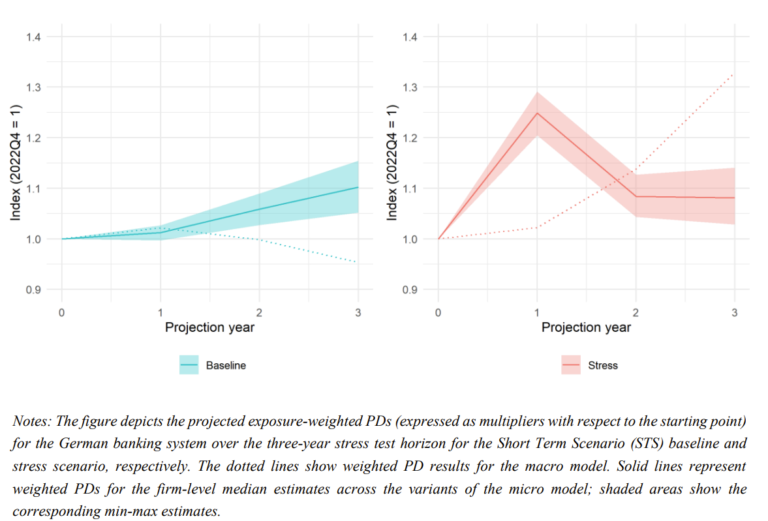

A short-term shock scenario in which the CO₂ price rises abruptly to 200 euros per tonne. In both scenarios, the average PDs of companies increase significantly over a three-year projection horizon. In the net zero 2050 scenario, the increase in median PDs is up to 40 %, with strong sectoral and company-specific heterogeneity becoming apparent.3

Particularly emissions-intensive sectors such as energy, transportation, agriculture and the basic materials industry record above-average growth, especially among companies with high emissions intensity and weak capital resources. A further look at the credit relationships of almost 1,300 German banks reveals an aggregated risk for the banking sector that can be classified as moderate overall.4

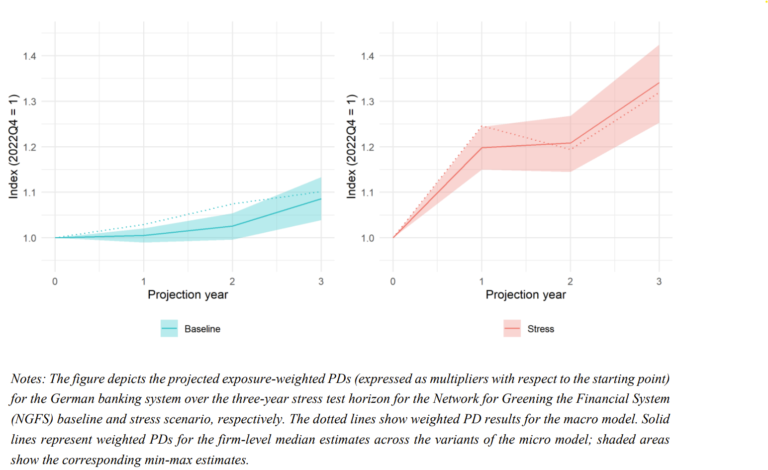

A comparison between the microeconomic and macroeconomic approaches shows a high degree of consistency in the aggregated PD trajectories (see Figure 1 for the “Net Zero 2050” scenario). The parallel modeling makes it clear that both approaches – despite different methodologies – arrive at similar risk trends, but open up different perspectives on the distribution of transition risks. While the micro model enables fine-grained differentiation within the sectors, the macro model tends to provide a more stable extrapolation.

Overall, the results of the Bundesbank stress test clearly show that climate-related transition risks could have a relevant impact on the credit risk profiles of companies in the foreseeable future – particularly in emissions-intensive sectors. The fact that climate-related risks do not only affect long-term scenario analyses may mean that climate risks are also relevant to supervision in the short term and therefore need to be integrated into risk-bearing capacity calculations or risk reports, for example by means of early warning indicators.

Figure 1: PD trajectories in the net-zero scenario (source: Gross et al. (2025), pp. 22–23, Figure 5)

Figure 2: PD trajectories in the short-term shock scenario (source: Gross et al. (2025), pp. 22–23, Figure 6)

From a data-intensive reference model to a practical solution

The study presented here shows that climate-related credit risks can be modeled and quantified in a differentiated manner – both at a microeconomic and macroeconomic level. Although the microeconomic approach allows a detailed differentiation at company level, such granularity is often not feasible in practice due to a lack of data. Many institutes therefore use a macroeconomic modeling strategy.

With msg.CST, we provide you with the necessary specialist logic from a single source: based on the Bundesbank study, historical default rates are modeled on the basis of a fractional response model5 using macroeconomic data (e.g. GDP and share price growth rates). To determine the sector-specific default rates, the difference between the GDP growth rates of the base scenario and the selected climate scenario is calculated and apportioned to sector level6 – the macroeconomic model is used to estimate the sector-specific default rates on the basis of the GDP forecasts scaled in this way. Our self-developed approach (already at the beginning of 2024) is thus obviously based on the same approach as the macroeconomic approach of Gross et al. (2025). The methodologically leaner design enables a flexible and user-friendly implementation of climate stress tests – the findings of the Bundesbank paper are also incorporated into our current further developments.

References and further information

-

1. Gross, C., Kuntz, L.-C., Niederauer, S., Strobel, L., & Zwanzger, J. (2025). Climate stress test for the German banking sector: Impact of the green transition on corporate loan portfolios, Deutsche Bundesbank Discussion Paper No. 11/2025.

-

2. The emissions data comes from the EU Emissions Trading System (EU ETS), the European Pollutant Release and Transfer Register (E-PRTR) and the ISS ESG database.

-

3. The progression and quantitative magnitude of the PD progressions of the micro and macro models are comparable.

-

4. Despite a moderate, aggregated risk for the banking sector, individual banks can be affected to an above-average extent. This applies in particular to smaller institutions with concentrated loan portfolios.

-

5. A fractional response model is a statistical regression model for values in the interval [0,1] based on generalized linear models (GLMs) with a logit or probit link function.

-

6. See also: Frankovic, I. (2022)

You must login to post a comment.