CRR III – the new IRBA

The “new IRBA” refers to the revision of the Internal Ratings Based Approach (IRBA) as part of the new EU capital requirements introduced by CRR III (Capital Requirements Regulation III). The revised Capital Requirements Regulation (CRR III) brings with it some serious changes that affect all credit institutions and all risk types. This article focuses on the main changes to the IRBA and the associated effects.

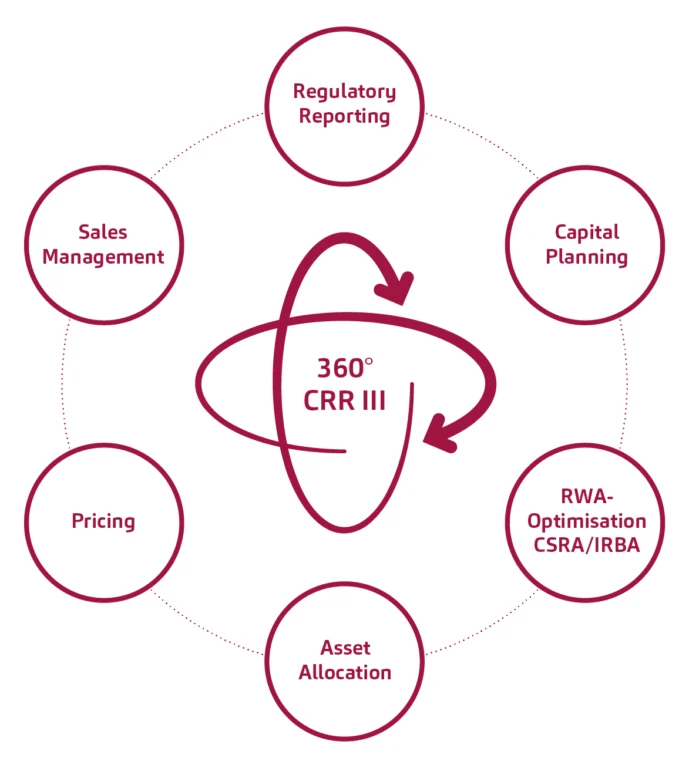

The revision of the Capital Requirements Regulation (CRR III), which comes into force in 2025, will have an impact on all credit institutions. With our 360-degree review, we shed light on all the effects of this reform: from capital planning, which already extends beyond the announced start of the new CRR at the beginning of 2025, to asset allocation, pricing, sales management and reporting requirements.

A final version of the revised CRR1 has been available since December 4, 2023 and is now undergoing the formal approval process. The major changes affect all credit institutions and all risk types. As foreseeable regulatory changes must be taken into account in capital planning at an early stage, IRBA institutions in particular need to take action now!

In the article “CRR III – the new CRSA“, we presented the changes to the Credit Risk Standardized Approach (CRSA) resulting from CRR III. In particular, it should be noted that, due to the output floor, the CRSA will also be relevant in future for institutions that have previously calculated their risk-weighted assets (RWA) entirely using the internal ratings-based approach (IRBA).

Output floor

As early as 2014, the Basel Committee on Banking Supervision (BCBS) discussed the use of capital floors based on the standardized approaches of the CRR in order to strengthen the minimum capital requirements for IRBA institutions.2 A concrete proposal for an output floor was included in Basel III in 2017. In 2019, BaFin explained the tightening of the IRBA as a whole:

On the one hand, this relates to the fact that the RWA savings from models are fundamentally limited by the output floor compared to the highly generalized standard approaches. On the other hand, there are changes in detail that ultimately aim to limit the freedom of modeling somewhat more. The aim is for banks to use models in a more targeted manner where the available data allows modeling.3

Miguel Guthausen, Can Tenschert-Voß and Michael Bruns Federal Financial Supervisory Authority

For the output floor in particular, the regulator provides for a number of transitional rules, which we set out in the article “CRR III – Transitional Provision“.

The capital floor applies to each institution as a whole, i.e. to the sum of all risk positions and not separately for risk types or exposure classes, and applies both to independent subsidiaries and at group level. In particular, this means that the new CRR does not follow the recommendation of the European Central Bank (ECB) to apply the capital requirements only at the “highest consolidation level” (group level).4

In order to determine the output floor, the institution must also calculate the capital requirement for each risk type and each segment for which the capital requirement is determined using internal models in accordance with the corresponding standardized approach.

The largest share of capital requirements is generally contributed by credit risk, so that the cap on capital savings resulting from the use of internal rating procedures in future compared to the use of the CRSA could also make a return to the CRSA for individual exposure classes attractive for IRBA institutions that currently cover most of their entire portfolio with internal rating procedures.

Changes to the internal ratings-based approach (IRBA) for credit risks

CRR III brings the following changes to the IRBA:

- The requirement to apply the IRBA comprehensively and, with a few exceptions, uniformly (“completely or not at all”) is no longer applicable.

- The risk exposure classes in the IRBA are defined somewhat more granularly and closer to the CRSA in order to simplify partial application. The previous retail and corporate exposure segments will each be divided into sub-segments, which can also be treated individually in accordance with the IRBA. New exposure classes for regional governments and local authorities (RGLA) and for public sector entities (PSE) will be introduced, which will be subject to uniform rules in the IRBA analogous to corporate exposures, particularly with regard to input floors.

- The use of the advanced IRBA, i.e. the use of internal models for estimating loss given default (LGD), is restricted for low default portfolios. It is no longer possible for receivables from banks and large companies (consolidated turnover of € 500 million or more), but is still possible for government bonds.

- Internal models for conversion factors (Credit Conversion Factor – CCF) can only be used for revolving receivables (except for banks and large companies). The standardized approach for CCF is used for all other exposure classes.

- In future, equity exposures can no longer be assessed using internal ratings, i.e. only the standardized approach with the new, higher risk weights will be used here.

- Credit risk mitigation techniques such as collateral and guarantees will be aligned with the CRSA.

- The input floors, i.e. the lower limits for estimating the PD (probability of default), LGD and CCF risk parameters, will be raised. For example, the minimum PDs for companies and institutions will be increased from 0.03% to 0.05%. For unsecured corporate receivables, the LGD will have a lower limit of 25%. If there is collateral, however, lower minimum LGDs of 15% and less are permitted – depending on the type of collateral. For revolving retail receivables, a sub-segment “QRRE Revolver” must be identified, which receives a higher minimum PD of 0.1 %. Finally, a minimum LGD of up to 50 % is introduced in the retail business, depending on the product and collateral.

- The supervisory parameters will be adjusted in the IRBA foundation approach. In particular, the LGD for unsecured corporate receivables will fall from 45 % to 40 %.

- There is a transitional phase not only for the gradual increase in the output floor, but also for other elements of the IRBA such as the input floor for special financing LGD and a volatility adjustment for non-cash collateral. All transitional provisions can be found in a separate article.

Impacts

The EU Commission expects the restriction of the IRBA with regard to rating procedures for institutions, large companies and equity investments to curb a significant source of inappropriate fluctuations in RWA and thus increase comparability between institutions while reducing complexity.5

In a survey conducted in 2022, the European Banking Authority (EBA) examined the impact of Basel III and its European implementation in the form of CRR III on the capital requirements of European banks in two groups:6 Banks with Tier 1 capital of at least € 3 billion and international business activities form Group 1, while smaller or non-international institutions form Group 2. To determine the impact, full implementation (after transitional phases) is assumed without adjustments to the business orientation or internal processes, in particular without the new option of partial use of the IRBA. The results show that the requirements for Common Equity Tier 1 capital will increase by around 15 % on average across all 160 participating institutions. The impact is greater for global systemically important institutions in particular, while the impact is less pronounced for smaller institutions.

The study also asked which specific regulations lead to relevant increases in each case. For IRBA institutions, these are primarily the output floor and the adjustments to the capital requirements for operational risk.7 In future, the capital requirement for operational risk must be calculated by all institutions using a new, uniform standardized approach. OpRisk models can no longer be used for Pillar 1 purposes. The extended requirements of the new standardized approach to credit risk have the greatest impact on CRSA institutions at an average of 8.8 %.

CRR III - 360° View

The changes to CRR III affect all credit institutions and all risk types and have a far-reaching impact on overall bank management. We present the key changes and areas where action is required in the near future.

The joint study by Deloitte and RSU, which is based on feedback from 52 institutions from Europe and the Asia-Pacific region from mid-2022, differentiates the impact on credit risk.8 According to the study, commercial real estate and equity investments are the exposure classes with the sharpest increase in core capital requirements in the CRSA, with off-balance sheet items (callable credit lines on current accounts and credit cards) and unrated institutions also being mentioned. In contrast, relief is expected in the residential real estate portfolio.

According to the study, the input floor for PD, LGD and CCF in particular has a negative impact within the IRBA. In contrast, the adjusted regulatory LGD values in the base IRBA and the elimination of the correction factor of 1.06 in the capital calculation have a positive effect. However, the output floor has the greatest capital-increasing effect for IRBA institutions.

Effect of the combination of partial use and output floor

The introduction of the output floor limits the advantage of the IRBA compared to the CRSA. At the same time, the possibility of permanent partial use of the IRBA means that its potential can be fully exploited by strategically selecting a few exposure classes with the greatest expected RWA reduction. Sophisticated or relatively small exposure classes that are problematic in terms of data availability or the number of defaults in modeling, for example, can be assessed using the CRSA. This future option will benefit current IRBA institutions just as much as CRSA institutions.

For example, CRSA institutions have the option of transferring only one or two relevant exposure classes to the IRBA in a focused project, thereby saving up to 27.5 % of the capital requirements compared to using the CRSA. Even with a conservative calculation, an institution with a balance sheet total in the mid single-digit billion range will benefit significantly from this. Increased interest in the introduction of the IRBA is therefore unmistakable in the German banking market.

In future, IRBA institutions will have the option of switching off internal models in those segments that contribute little to RWA savings or in those that are particularly costly in terms of model monitoring and validation due to their complexity or low default figures. This permission for IRBA institutions to switch to the standardized approach with individual IRBA asset classes exists during a transitional phase of three years from the entry into force of CRR III. In this context, the above-mentioned study by Deloitte and RSU reports that several IRBA institutions are interested in switching individual exposure classes to the CRSA.

Implementation of CRSA and IRBA - We support you.

In addition to the 360-degree review for CRR III, we also offer you support with the implementation of the CRSA and IRBA. For more than 15 years, we have been a reliable and experienced partner for many satisfied institutions of different orientation and size in the implementation of Basel, SolvV and CRR.

Quellen

-

1. Council of the european union, Proposal for a Regulation of the European Parliament… - Confirmation of the final compromise text with a view to agreement, 04.12.2023

-

2. BCBS, Consultative Document – Standards – Capital floors: the design of a framework based on standardised approaches, 2014

-

3. Opinion of the European Central Bank, 24.03.2022

-

4. Explanation in the EU Commission's proposal for CRR III of 27.10.2021

-

5. EBA, BASEL III Monitoring Exercise – Results based on Data as of 31 December 2021, September 2022

-

6. In future, the capital requirement for operational risks must be determined by all institutions in accordance with a new, uniform standardized approach. OpRisk models can no longer be used for Pillar 1 purposes.

-

7. Deloitte and RSU, CRR III Survey 2023 - Impact and challenges, 2023

You must login to post a comment.