Efficient mapping of stress scenarios

Stress scenarios are key components of modern risk management at credit institutions. Creating and implementing bank-specific stress tests that take all regulatory requirements into account is proving to be a challenging task for many institutions. This article highlights how banks are managing to map stress scenarios more efficiently.

Stress tests can be used to simulate extreme but plausible conditions, assess a bank’s risk-bearing capacity based on their impact and take suitable countermeasures in advance.

Today, stress scenarios are one of the central components of risk management and must be maintained for all risk types – now also for regulatory reports in some cases.

The following stress tests and scenarios should be mentioned in particular:

- Interest rate risk scenarios for IRRBB reporting (present value EVE view and multi-period NII view): In addition to the simulation, the results must be submitted to the supervisory authority on a granular basis.

- Credit risk stress tests, as the estimated credit risk parameters PD and LGD are subject to uncertainties and can lead to massive effects on results in the risk ratios.

- Stress tests in liquidity risk, primarily focussing on short-term solvency.

- Overall bank stress tests to analyse the effects of a stress event across all risk types

- Climate stress tests with a view to a longer analysis period of up to 30 years

Valuable insights from stress tests

Stress tests provide banks with important insights into their resilience, their limits and their bottlenecks, as well as degrees of freedom that they can use to further develop their business area and risk management processes.

However, the development and implementation of bank-specific stress tests in compliance with all regulatory requirements often presents banks with challenges.

Using msg.ORRP efficiently to map stress scenarios

The new software solution msg.ORRP (Open Risk and Reporting Platform) for risk management and regulatory reporting offers banks a high level of convenience for modelling stress scenarios appropriately. And it provides comprehensive support for the above-mentioned scenario modelling.

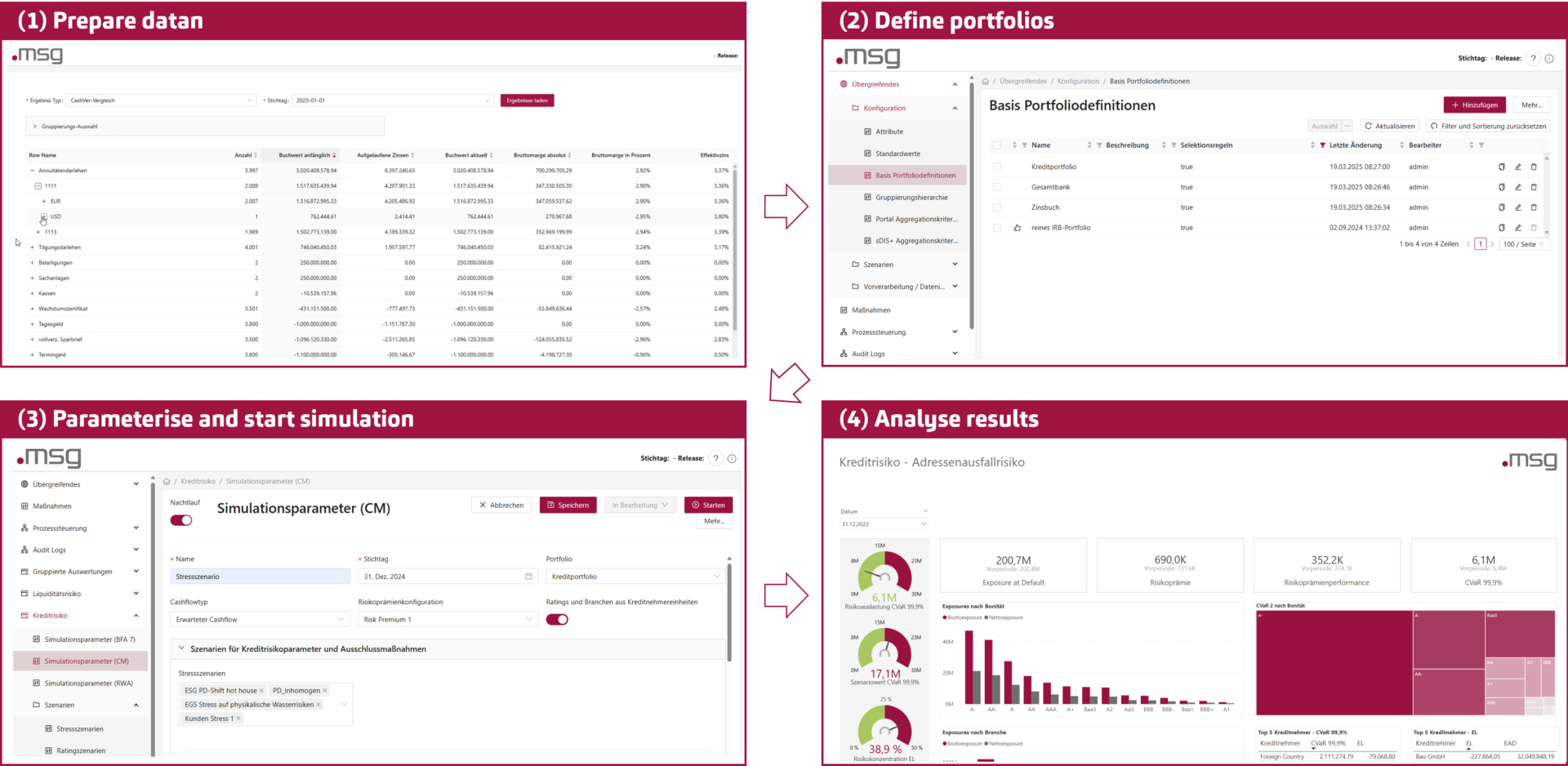

The following graphic shows the central steps in scenario modelling. In the second and third steps in particular, the associated scenario assumptions are translated into scenario sets/configurations depending on the scenario and then applied as part of the simulation.

Figure: Integrated workflow in msg.ORRP using the example of CreditRisk (click to enlarge)

Depending on the focus of the scenario, sub-portfolios can be individually selected in a very granular manner based on “criteria and attributes” and then mapped with correspondingly changed parameters compared to the normal scenario. In credit risk, for example, changed probabilities of default or loss ratios can be assigned depending on the rating class and sector affiliation.

In liquidity risk, for example, there are changes in call-up rates for various products.

In the climate stress test, the challenge is that changed assumptions must be incorporated into the multi-year forecast over a longer period of time, meaning that the forecasting must be flexible.

In interest rate risk, one of the main requirements at present is that the simulated results must also be submitted to the supervisory authority in granular form on a quarterly basis.

msg.ORRP provides comprehensive and audit-proof support for these various processes. A dual control principle, approval procedures, journalization and historization are central elements, especially for stress scenarios and the changed parameterizations, so that these processes can be designed transparently and comprehensibly for all parties involved.

Conclusion

Stress tests are an indispensable tool in modern risk management at banks. They provide important insights into the institutions’ risk-bearing capacity and help to recognise weaknesses at an early stage and derive suitable risk mitigation measures.

The requirements for the scope and documentation of stress tests are high and relate to all relevant risk types – from interest rate and credit risks to liquidity and climate risks. In order to meet these requirements, integrated, flexible and comprehensible processes are needed that enable consistent modelling, simulation and evaluation – both for internal management purposes and to comply with regulatory requirements.

msg.ORRP - Risk management & reporting combined on one platform

The future of your bank controlling starts now. Find out more about our platform, which offers a comprehensive range of services for risk management, financial controlling and regulatory reporting.

You must login to post a comment.